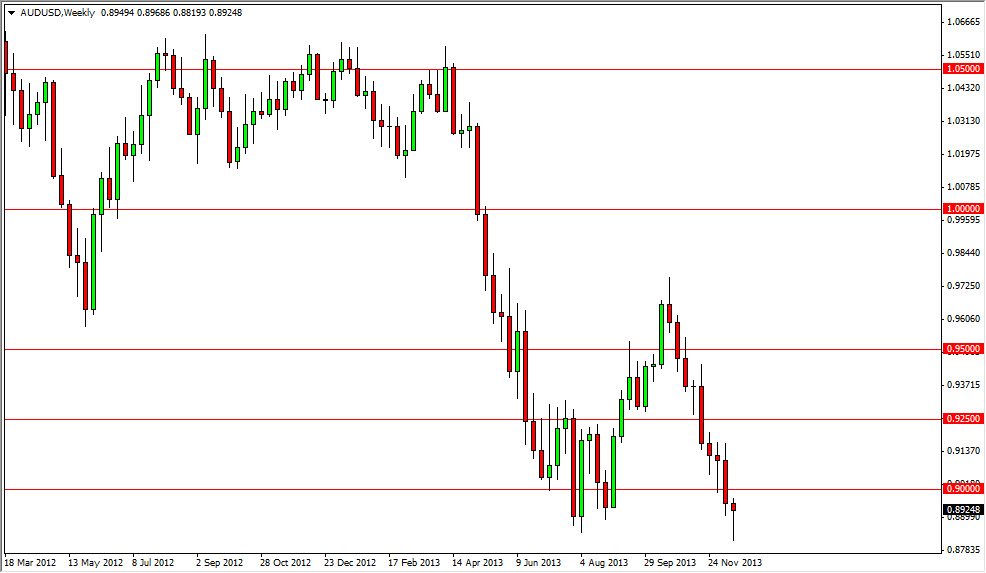

AUD/USD

Probably the most interesting pair for me at the moment, the Aussie looks as if it is trying to find a bottom here. However, I would be careful to read too much into it as Christmas is Wednesday. This could simply be people taking profit before the holidays. Nonetheless, the market has formed a hammer, and because of this I think that the next couple of weeks will become vital. The jobs situation in America will be important, mainly because of potential tapering by the Fed. With that in mind, if we break the bottom of the hammer – gold AND the Aussie will be punished. Could be the trade of Q1 next year.

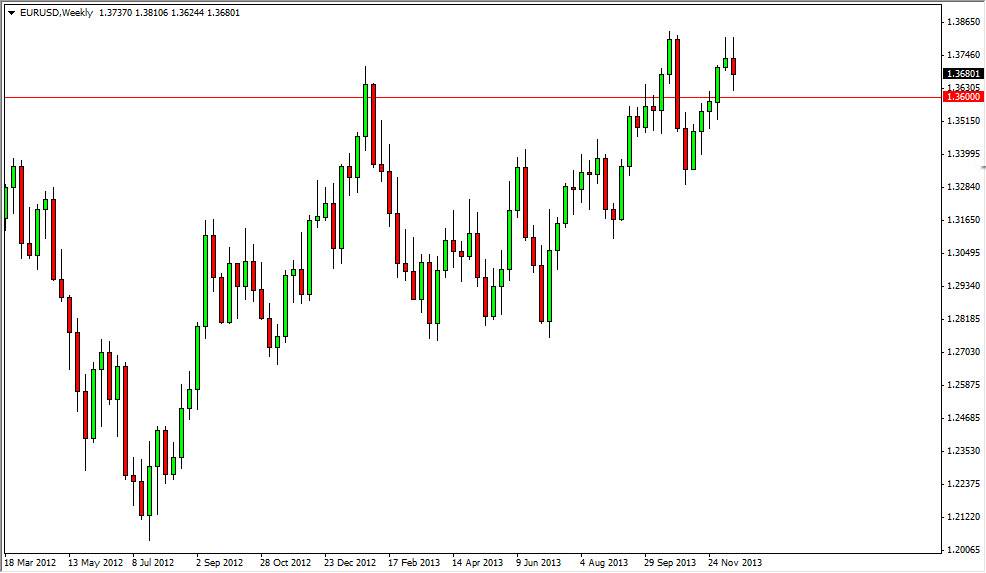

EUR/USD

This pair is going to chop around for a while. I have been saying this for two years basically, and that’s all it has done. It appears based upon the last weekly candle that we have only confirmed that the 1.38 level is resistance, and the 1.36 level is support. That isn’t going to change before January.

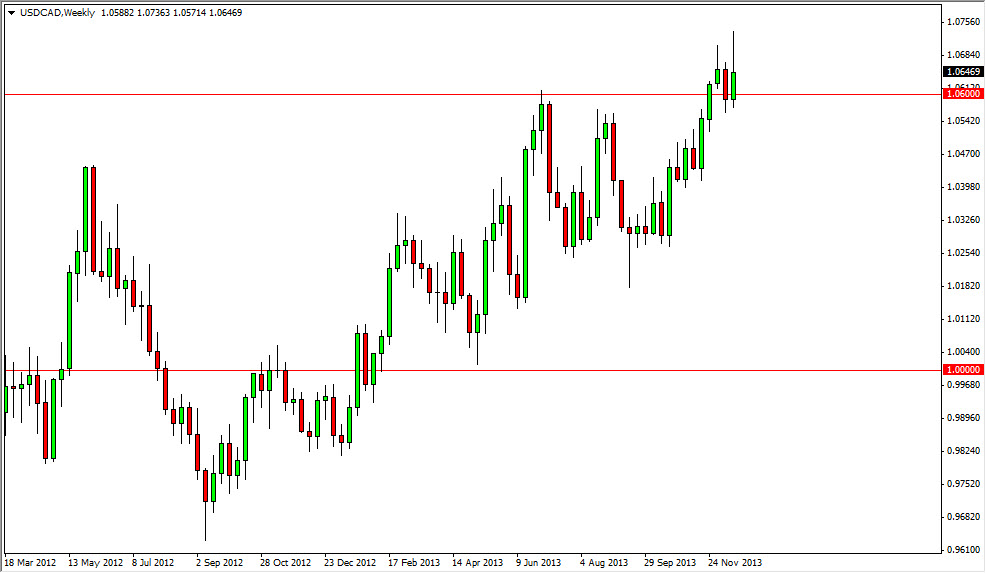

USD/CAD

The USD/CAD pair tried to break out above the 1.07 level, but found it too difficult. However, I think it will still happen, and the time of the year stopped it more than anything else. Because of this, I am still bullish of this pair, and would be interested in buying on signs of support in the 1.05-1.06 range. Because of this, I am planning on going long, but the next week will be difficult – for all markets.

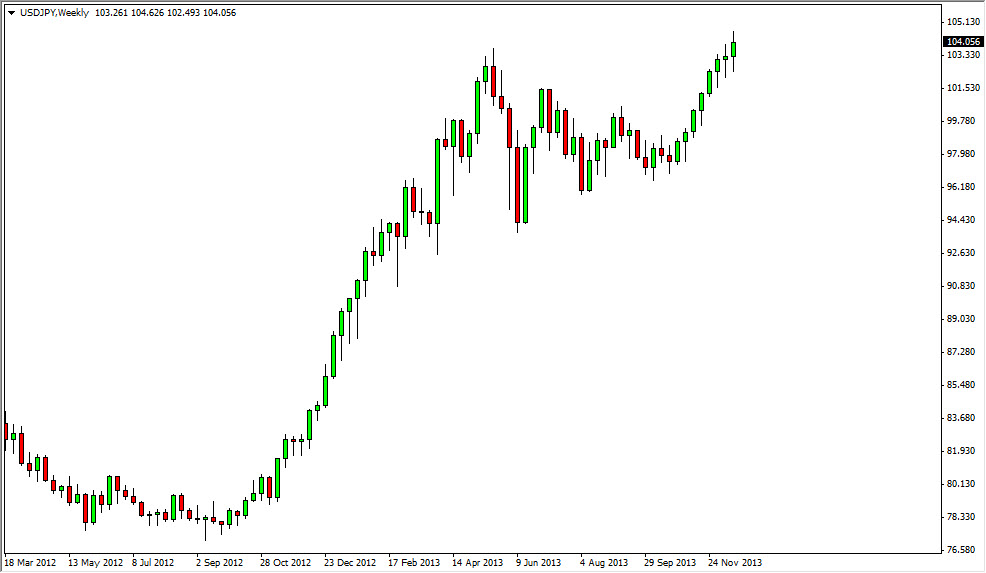

USD/JPY

This is the other pair that I like a lot at the moment. The USD/JPY could be facing a “perfect storm” in the next few years, and we are at the beginning of it. The Federal Reserve will continue to taper sooner or later, and the Bank of Japan will continue to work against the value of the Yen. Quite frankly, the BoJ would LOVE to see this pair at 125. It is going to get there, given enough time. However, can you hold onto a core position long enough to take advantage of it? I for one will be long of this pair for the next couple of years in one capacity or another. I will also add when I get a chance. Hello 2001 – 2006 again…