USD/JPY

The USD/JPY pair continued to go higher over the last week, which I think will continue to be the case going longer term. This is because the central banks are diametrically opposed as far as their stance, as the Bank of Japan has recently started to loosen its monetary policy even more, while the Federal Reserve may possibly be able to taper in the next couple of months. Because of this, I expected this pair will continue to go higher, probably for years to come. I am already long of this pair, and as a result will add to my position on dips going forward. I believe the next target will be 103, followed by 105, and then 108.

EUR/USD

The EUR/USD pair fell down to the 1.35 level during the sessions over the past week, but bounced hard enough to form a hammer that looks ready to go higher. A break of the top of the hammer for the week should send this market looking for the 1.38 handle, which has been relatively resistive in the past.

If we break down below the 1.35 handle, I think that there is still a significant amount of support below, and I would be a bit hesitant to sell this market. The one caveat of course is the fact that the nonfarm payroll numbers come out on Friday, and that will massively affect where this pair goes next. If the jobs number comes out strong, that might be a reason to start selling as it would favor the Federal Reserve tapering sooner than expected.

USD/CAD

The USD/CAD pair finally broke out above the 1.06 handle, which was the area that I needed to see this market break above in order to start buying and holding this pair. The 1.10 level is the next target. As far as I can tell, and based upon the longer-term charts I think this pair could go that high very quickly. With that being the case, I think building a position from here is probably the best way to go.

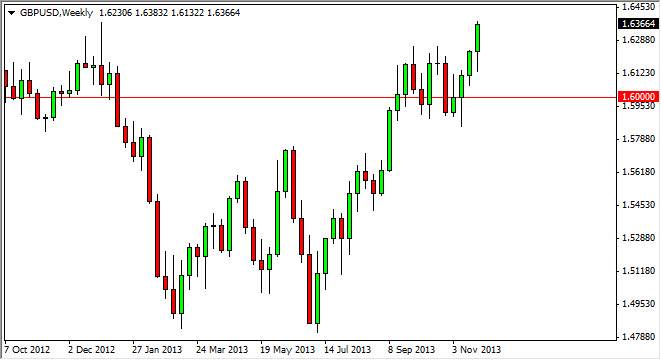

GBP/USD

The GBP/USD pair finally got above the 1.63 level during the week, which was much like the USD/CAD pair, an area that I needed to see this market close above in order to start buying again. I think that the 1.65 level will be targeted next, and then possibly the 1.70 level. However, nonfarm payroll have a massive effect on this market as well, and any hints of the Federal Reserve tapering sooner will have this market falling and will completely change the complexity of it.