USD/JPY Signal Update

Taking yesterday’s two long signals in turn:

Long Trade 1

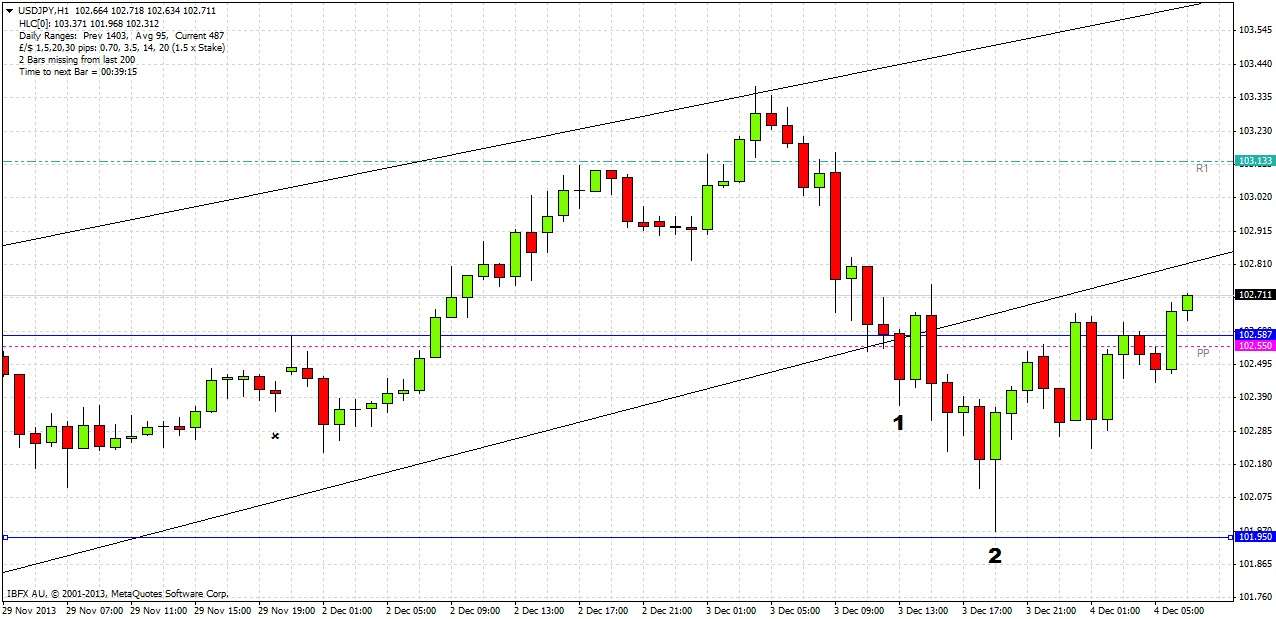

We were seeking a confirmation bar touching support level at 102.59, ideally with lower wick touching in confluence with the lower channel trend line and the S1 GMT daily pivot point.

Stop loss just below the lower of the local swing low or 102.30.

Take 75% of the position as profit at 102.99. The level of 102.59 was hit and provided some short-term support, but broke with a bearish candle forming almost entirely below the level, marked at (1) on the chart below. This was then followed by a bullish engulfing candle which broke to the upside, but it should have been clear not to take this trade after an hourly bar formed almost entirely below the support level. To be clear, confirmation bars should only be taken when the S/R level is being well respected.

Long Trade 2

This trade was to be taken only if price falls through the support level at 102.59 without any pull back.

Enter long with a limit order at a touch of 101.95.

Stop loss at 101.67.

Take profit on 50% of the position at 102.50.

Unfortunately, the price came to within less than 2 pips of the long entry level, which was at the blue line marked at (2) in the chart above. If you were fortunate enough to have been got into this trade by your broker’s price feed being a little low, congratulations, you have some profit already. It would be a good idea to take just a little more profit right away so that even if the trade is stopped out, the final reward to risk will be 1:1. Hold the rest and hope for a move upwards later today.

Today’s USD/JPY Signal

There is no signal today.

USD/JPY Analysis

There are important news items due later today for the USD at 1:15pm, 1:30pm and 3pm London time.

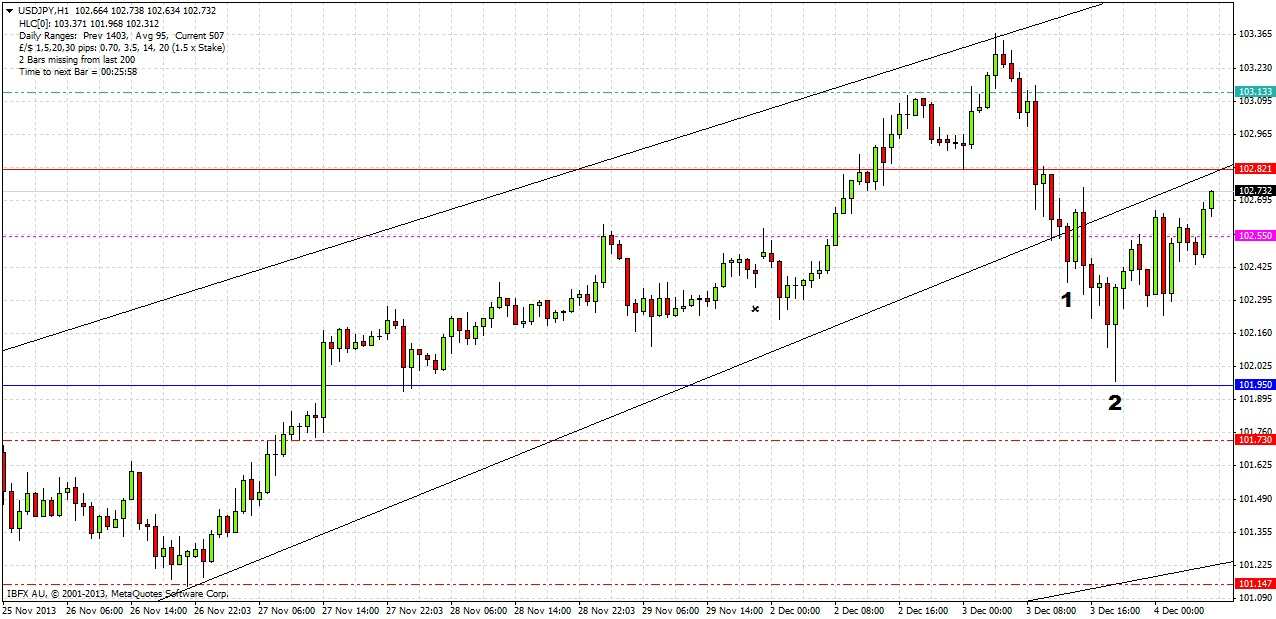

We were correct yesterday in taking a bullish bias. Yesterday the pair broke down through the bullish channel lower trend line and the support level at 102.58. There was a hint this would happen following the formation of support turned into resistance locally at 102.82, though this is a minor level and has not been retested yet. The area around 102.00 acted as strong support yesterday from which the price has since travelled upwards with good momentum.

This is not given as a signal but it could be possible to take a short coinciding with a rejection of a retest of the broken trend line confluent with the possible resistance level at 102.81, marked in red in the chart below

A retest of 102.00 – 101.90 could lead to another upwards move. However it is likely that little will happen until the news later today in the first part of the New York session. We may see volatility from the news so trade carefully.