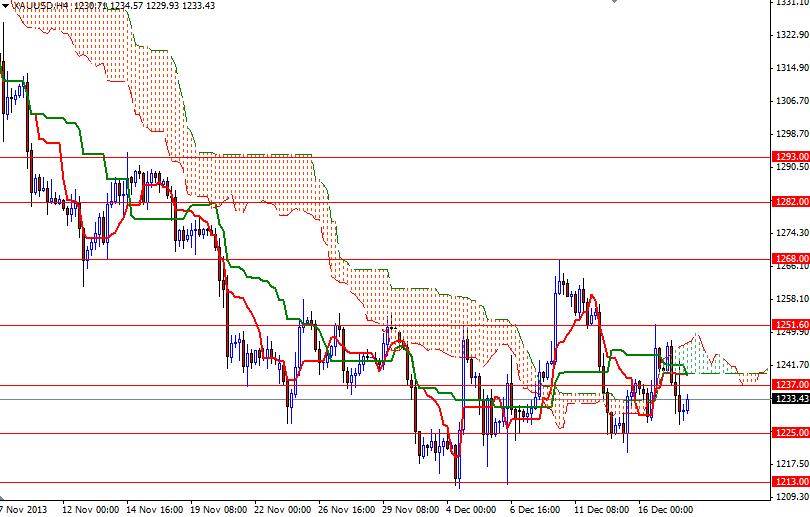

The XAU/USD pair closed the day lower after two consecutive days of gains. Without doubt, the outcome of the Federal Open Market Committee meeting will be the next big market catalyst. Even though I do not expect any major changes in the U.S. central bank's easing policy until January or March, I will be waiting to hear how the Federal Reserve will react to the recent changes in the economy. For the last four weeks, we have been trapped between the 1225 and 1252 levels. During this time the bears tried to capture the first strategic fort at 1213 but failed.

Similarly, the bulls attempted to break through 1268 and that didn’t work as well. I think what Chairman Bernanke tells us today will help the XAU/USD pair to break out of this consolidation. If Fed policy makers decide to await more evidence that progress will be sustained before adjusting the pace of asset purchases, I expect to see some profit taking and probably a pull back towards the top of the descending channel where the Ichimoku clouds reside on the daily chart.

Technically speaking, climbing above the 1251.60 - 1253.90 resistance zone which coincides with the Kijun-sen line (twenty six-day moving average, green line) could lure more buyers. In that case, I think the bulls will gather enough strength to challenge the bears at the 1268 level. Once above that, the bulls will be aiming for 1282 next. On the other hand, a daily close below the 1225 support level would shift momentum to the bears’ favor and clear the path to 1213. If gold prices break below this support, we will probably see 1200 printing on our charts soon after.