The XAU/USD pair ended the week higher after the Friday's slightly bullish price action. The pair had tried to rally on Tuesday but heavy resistance around the 1268 level stopped the bulls' advance. Several economic data will be released from the United States over the week but without doubt the main event is going to be the Federal Open Market Committee meeting and Chairman Bernanke’s press conference on Wednesday.

The focus remains on whether the recent batch of encouraging economic data out of the U.S. and the budget agreement in Congress are enough to warrant action from the central bank to begin its retreat strategy this week. Although recent news stoked bets the Federal Reserve will start slowing the pace of its bond-buying program on Wednesday, the XAU/USD pair was somehow resilient to the bears' attacks last week.

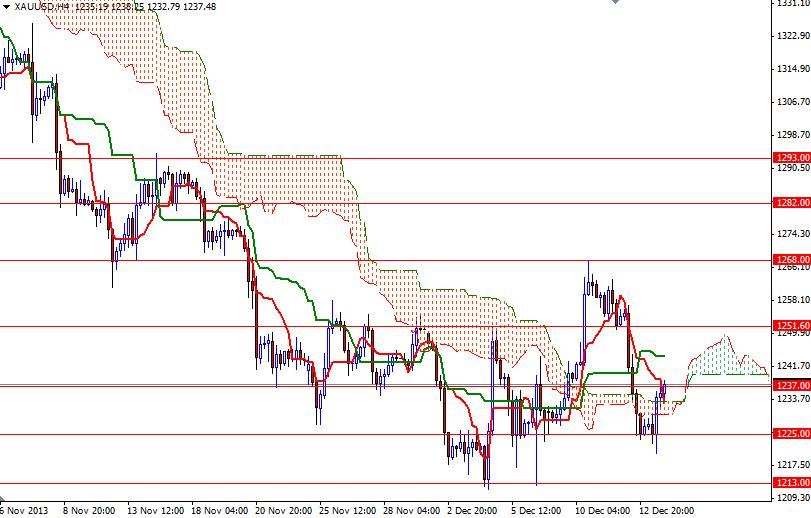

From a technical point of view, I think there are two things to pay close attention. First of all, the XAU/USD pair is trading below the Ichimoku clouds on the weekly and daily time frames, indicating that higher prices will continue to attract sellers in the medium-term. This theory is also supported by the descending channel which the pair has been respecting since September.

The next thing is the temporary bottom formed around the 1213 level. With that in mind, I think it is possible to see prices touching the top of channel before reversing and heading much lower. Of course, the precious metal's fate will depend how the Federal Reserve plays its cards. In the meantime, I will be watching the 1252 and 1225 levels. If the bears increase the downward pressure and prices close below 1225, the pair may revisit the 1213 support level.

Below that, the next challenge will be waiting the bears at 1200. It is quite possible that the pair will gain some traction if it can push through resistance at 1252. If that is the case, I think the 1268 resistance will be tested again. Once the bulls capture this strategic point, the next target will be 1282.