GBP/USD Signal Update

Yesterday’s signal was not triggered and expired.

Today’s GBP/USD Signal

Risk 0.50%

Entry should be made between 8am and 5pm London time today only.

Enter at the first to occur only after a next bar long break of a confirming pin bar, engulfing bar or strong outside bar as follows:

Long Trade 1

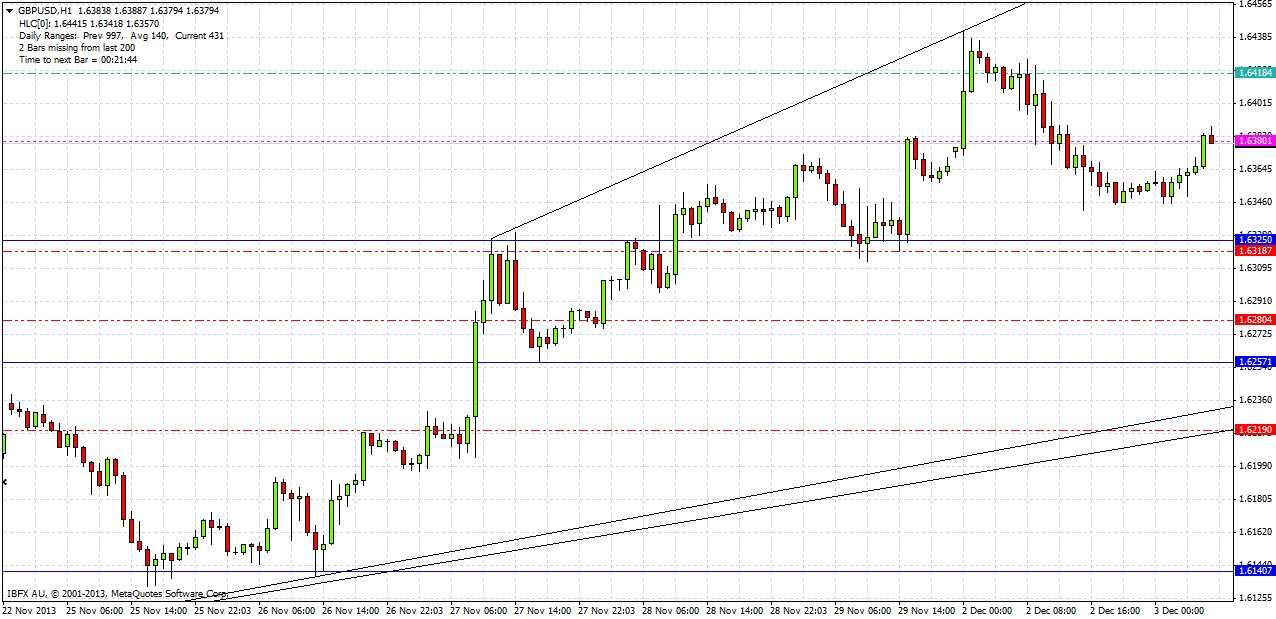

Enter long after confirmation bar touching support level at 1.6325, ideally confluent with S1 GMT daily pivot point.

Stop loss at the lower of local swing low or 1.6290.

Move stop loss to break even and take half the position as profit when the price reaches 1.6375.

Long Trade 2

This trade to be taken only if price falls through the support level at 1.6325 without any pull back.

Enter long with a limit order at a touch of 1.6260.

Stop loss at the lower of local swing low, initially 1.6218.

Move stop loss to break even and take profit on half of the position at 1.6375.

This could be a really great trade if the entry happens late enough to be confluent with one or both of the bullish trend lines shown in the chart below:

GBP/USD Analysis

The pair may move strongly this morning as there is an important news release scheduled for 9:30 London time: UK Construction PMI data

The pair has been in a strong uptrend since early November, but sold off yesterday, reaching a low of 1.6341 at one point before recovering late in the Asian session this morning. However there is no technical reason to say the uptrend has ended, so we maintain our long bias.

There are key support levels at 1.6325 and 1.6257, which the latter likely to be stronger. Both of these levels are currently above bullish trend lines that stretch back to mid-November.