Risk 0.50%

Entry should be made between 8am and 1pm London time today only.

Enter long at 1.6325.

Stop loss at 1.6290.

Move stop loss to break even and take half the position as profit when the price reaches 1.6375.

GBP/USD Analysis

The pair may move strongly today as there are important events scheduled for both GBP (Manufacturing PMI is released at 9:30am London time) and USD (Bernanke is speaking at 1:30pm London time).

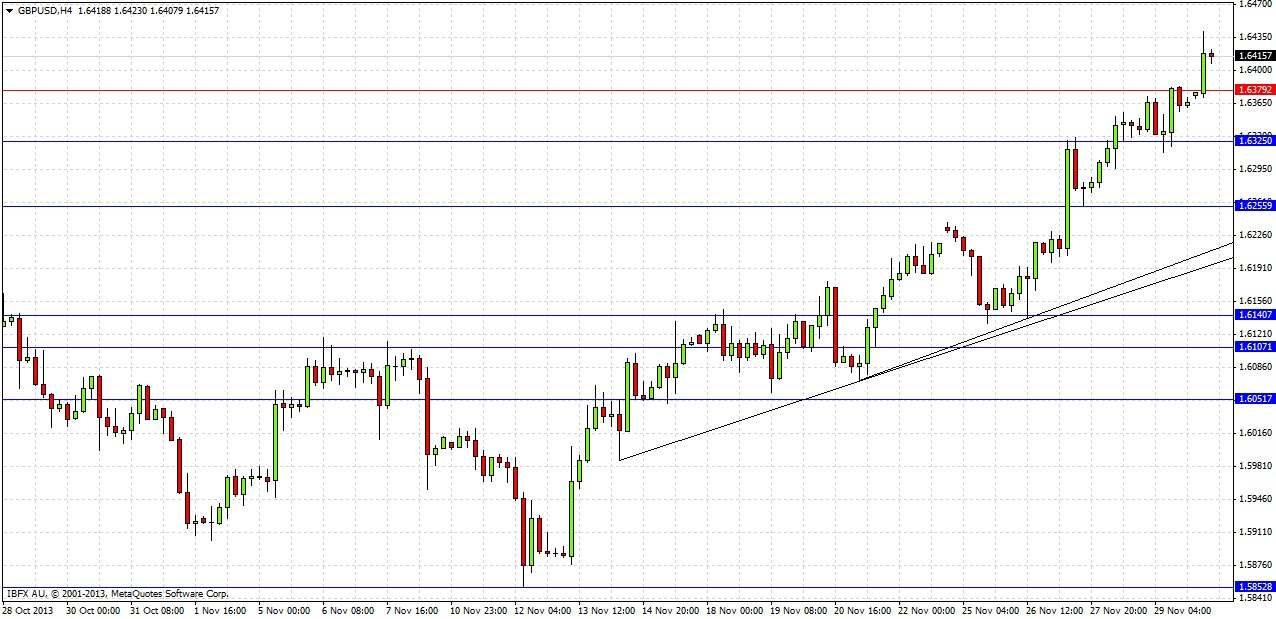

The pair has been in a strong uptrend since early November, dramatically breaking through the key 1.6250 resistance level last week, and making a new 2 year high last Friday, as shown in the 4 hour chart below, marked with key S/R levels and a bullish trend line.

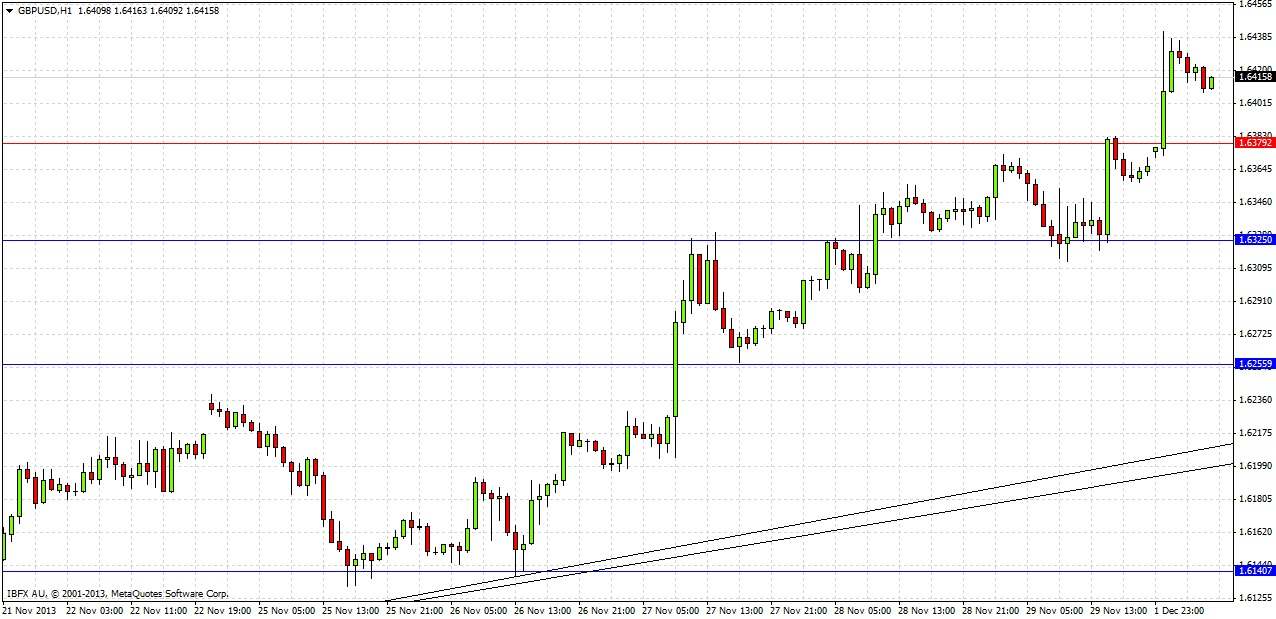

The chart above shows key S/R levels and a bullish trend line.

Although early action this morning has shown a “falling off” from the new high with inside bars, the strong bullish trend and the confluent level at 1.6325 of resistance turned into support and the GMT S1 pivot suggest a long trade off a pull back to this level.