GBP/USD Signal Update

The long touch trade at 1.6230 in yesterday’s signals was triggered towards the end of yesterday’s London session. The trade turned profitable almost immediately and reached the first exit of 1.6250 where 80% of the position was to be taken off. It was recommended earlier today in a previous update to take the remaining 20% of the position as profit for reasons that will be explained in the analysis below. At the time of writing the price was about 1.6281 so that should have given approximately 50 pips on the 20% and 20 pips on the 80% giving a total of about 26 pips. This was less than risk but it was deemed to be a very high-probability trade.

Today’s GBP/USD Signals

Risk 0.25%.

Entry should be made before 5pm London time today only.

Long Trade 1

Enter long at the next bar break of an hourly pin or strong engulfing or outside bar rejecting and closing above the support level of 1.6195. If this level is not touched and rejected by the same hourly bar, or if an hourly bar closes more than a few pips above this level, the trade is immediately invalidated and should not be taken.

Stop loss at the local swing low, it should in any case be lower than 1.6165.

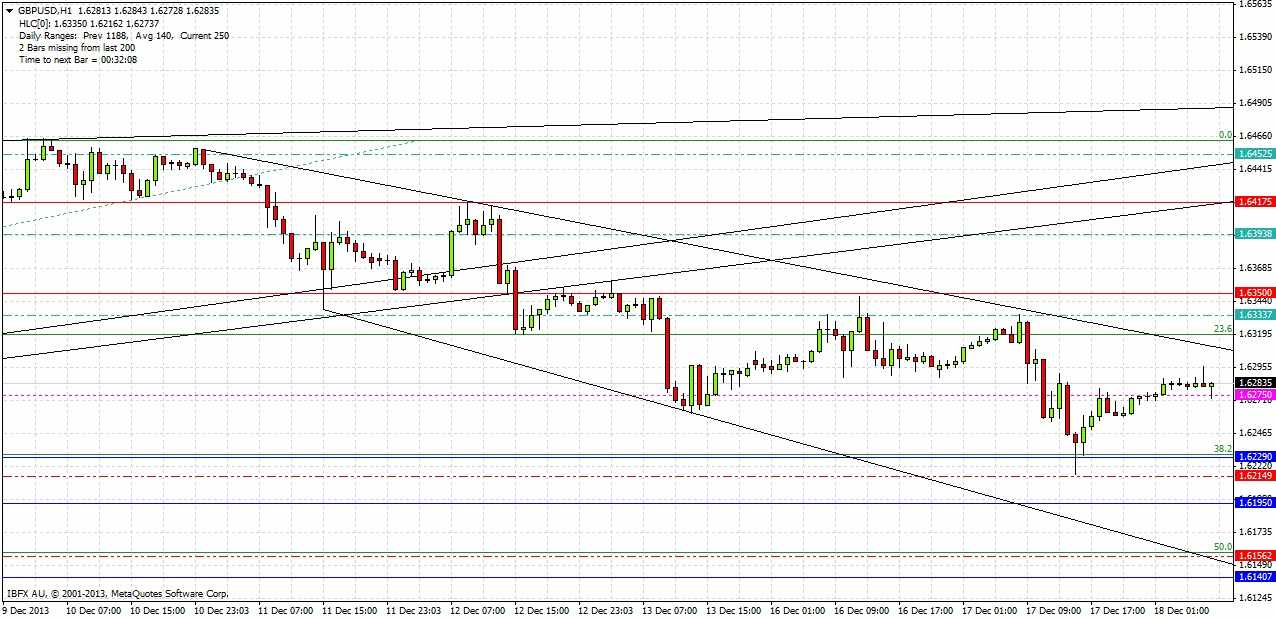

Take profit on 75% of the position at 1.6230 and move the stop to break even. Let the rest of the position ride and take the remainder of the position as profit at a touch of the upper channel trend line (see chart below).

Long Trade 2

Enter long at the next bar break of an hourly pin or strong engulfing or outside bar rejecting and closing above the support level of 1.6140. If this level is not touched and rejected by the same hourly bar, or if an hourly bar closes more than a few pips above this level, the trade is immediately invalidated and should not be taken.

Stop loss at the local swing low, it should in any case be lower than 1.6128.

Take profit on 75% of the position at 1.6190 and move the stop to break even. Let the rest of the position ride and take the remainder of the position as profit at a touch of the upper channel trend line (see chart below).

Short Trade 1

Enter a short touch trade by placing a limit order at 1.6416 with an initial stop loss at 1.6456.

Take profit on 75% of the position at 1.6355 and move the stop loss to break even.

Take half of the remainder of the position as profit at 1.6260. Let the rest of the position ride.

GBP/USD Analysis

Major news is expected today for both GBP and USD. At 9:30am London time there is a whole slew of data and decisions, then at 1:30pm there is USD Building Permits data. Most importantly, at 7pm London time there is an FOMC statement and projections that are eagerly awaited by the market and which are likely to strongly affect the USD. Therefore any trades taken should be monitored at this time and if the news is very unfavourable for the trade, it should be exited immediately.

Yesterday saw a fast move down but then a strong bounce up from the support at 1.6230. It became apparent during the London session that this pair has established a bearish channel, necessitating a conservative final profit target on yesterday’s long trade, hence this morning’s hasty exit. As can be seen in the chart below, the price is currently not far from the channel’s upper trend line.

I see more potential on the bear side due to the channel but due to the uncertainty ahead of tonight’s FOMC statement, a long trade is also possible. It is unlikely any of the trades mentioned earlier will be triggered as today’s London session is likely to be fairly quiet.