EUR/USD Signal Update

Wednesday’s signals were not triggered and expired

Today’s EUR/USD Signals

Risk 0.50%.

Entry should be made before 5pm London time today only.

Long Trade 1

Enter long at the next bar break of an hourly pin or strong engulfing or outside bar rejecting and closing above the resistance level of 1.3618. If this level is not touched and rejected by the same hourly bar, or if an hourly bar closes more than a few pips below this level, the trade is immediately invalidated and should not be taken.

Stop loss at the local swing low or 1.3590, depending upon how close the entry is to 1.3618. If the entry is very close, then the lower of the two should definitely be used.

Take profit on 75% of the position at 1.3645 and tighten the stop by using a trailing stop of the distance to the entry. Let the rest of the position ride.

EUR/USD Analysis

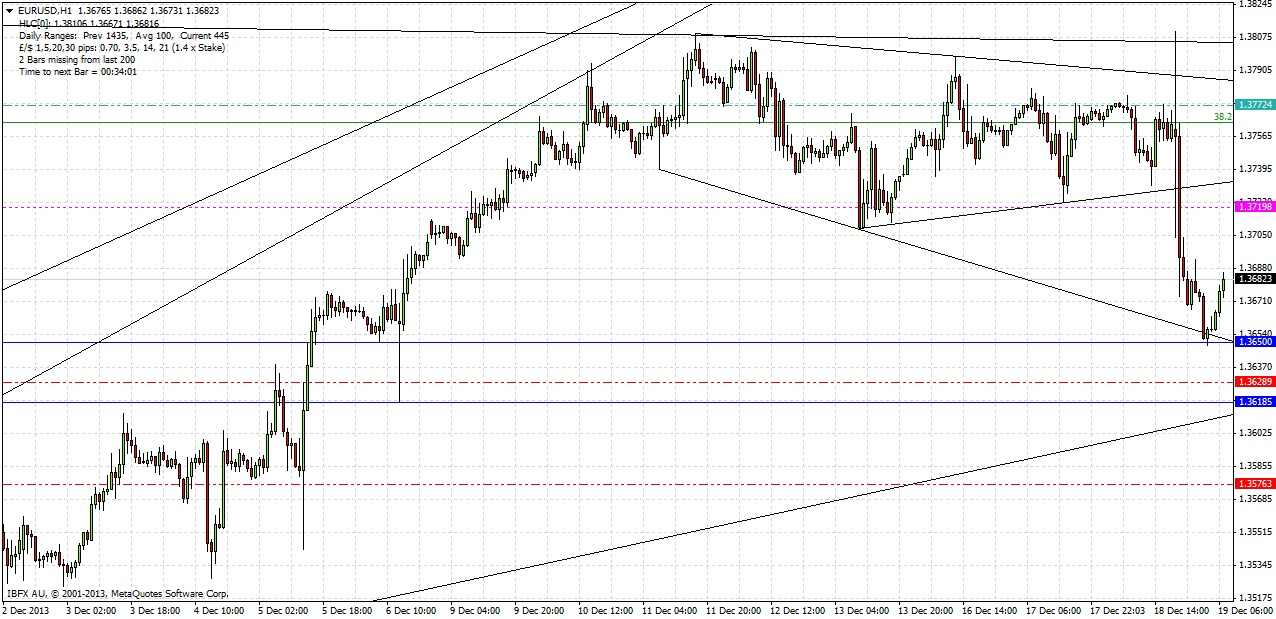

Yesterday’s FOMC statement has changed the market sentiment to be markedly more positive on the USD. The USD rose sharply against the JPY and also against the EUR, forming a bearish EUR/USD outside bar closing in its lower quartile on yesterday’s GMT daily candle. The low of this daily candle at 1.3667 was already broken earlier during the Asian session.

There is important news today for the USD at 1:30pm (Unemployment Claims) and 5pm (Existing Home Sales and Philly Fed Manufacturing Index) London time.

It is worth noting that the EUR is quite resilient. When the price hit my previously identified major support level of 1.3650 a few hours ago, it rallied quite strongly, rising almost 40 pips since at the time of writing.

The daily candle indicates a further fall is likely to about 1.3525 before we break 1.3808 again. Unfortunately there is no obvious and safe entry point for a short trade that can be identified on the chart today. Long-term traders may wish to simply go short at market or on a retracement to the broken bullish trend line or daily pivot with a stop past the yearly high above 1.3800, though I am not giving this as a signal.

Due to the resilience in EUR, I am prepared to look at a long trade confirmed by price action should we reach the strong support level of 1.3618 during the London session today.

Interestingly, despite yesterday’s dramatic news, the pair has “behaved” technically as can be seen in the chart below. See how the new bearish channel within the longer term uptrend which price started to form at the end of last week held both last night, and also this morning when the lower trend line of the bearish channel was reached: