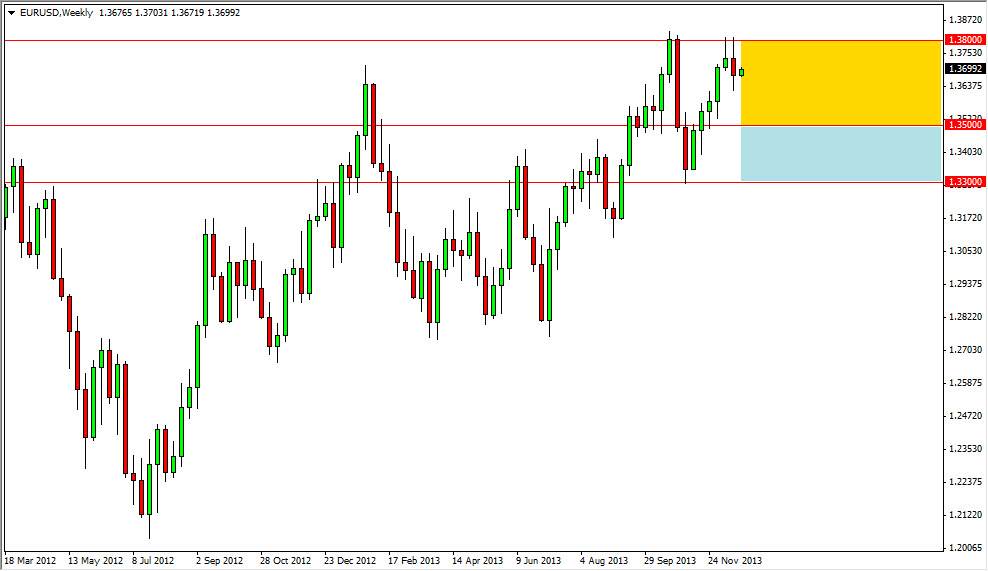

The EUR USD pair has been trapped in a relatively sizable range for several weeks now, and going into the month of January I do not expect to see a whole lot of change to that pattern. As you can see on the chart attached to this article, I have two rectangles painted on the chart. The first one is in a gold color, and I believe that is where the majority of trading will happen during the month of January. However, there is the possibility that we fall bit further, and that is what the blue rectangle represents. As you can see, the trading range has been between 1.33 on the bottom, and 1.38 on the top. I suspect that most of the trading will be done in this range, if not all during the month of January.

The one caveat would be if something happens in the United States to suddenly weaken the US dollar. The only thing that I can foresee doing that would be the nonfarm payroll report coming out early January. That would be the one possible kink in the scenario, if the jobs number was horrible. However, keep in mind that a poor jobs number for the month of December can be written off as simply being the time of year as well, so it’s possible that the market may react negatively, and then turn back around.

1.38 will be a significant barrier

In the meantime, I believe that the 1.38 level will hold up as resistance. Again though, a poor jobs number would be the one thing that could change that completely. Ultimately, I think that the market will probably stay in a fairly tight range as we try to figure out what’s going to happen with tapering and the United States. On top of that, let us not forget that the Europeans are suddenly worried about deflation, which almost guarantee some type of loosening policy out of the European Central Bank. That of course would be very negative for the Euro as well. I’m not predicting any type of major selloff, just that week will more than likely grind a bit in the meantime.