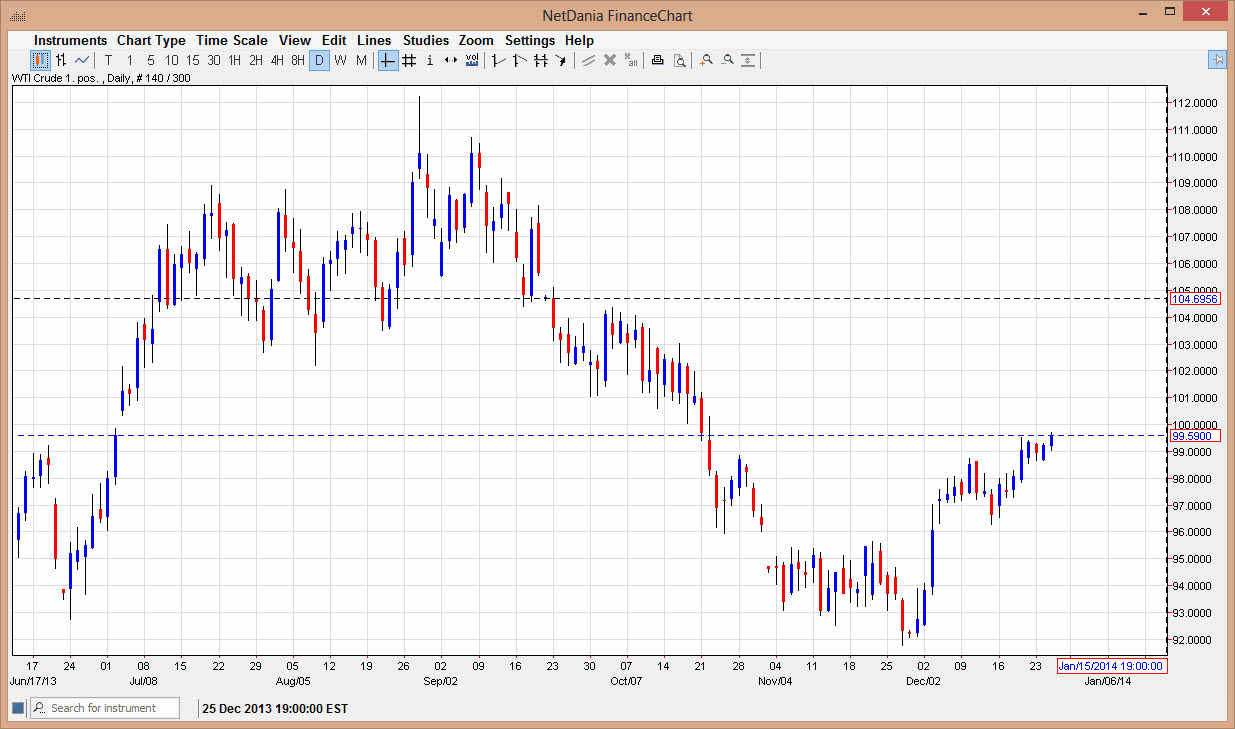

The WTI Crude Oil markets had a positive session on Thursday, as traders came back from the Christmas break. The market of course closed above the $99.50 level, which is a slightly significant when for the buyers, as it has kept the buyers at bay for a few sessions. Nonetheless, I still believe that this market is heading to the $101 level, which is the previous support zone from the end of September, early part of October.

I think that if we can get above that level, the market will try to reach the 104 level, as it was the top of that same consolidation area. The market tends the move back and forth through these consolidation area is over time, and the WTI market seems to be particularly technical and its moves in that aspect. I believe that this market will continue to go higher over time, but we have to keep in mind that the liquidity could be a problem at the moment, thereby making it a choppy move at best.

Only the strong need apply.

This is the type of move that will be choppy at best, and it will shake a lot of traders out. However, if you have the ability to hang onto a trade through volatility, you may find this move could be very profitable in the end. It really comes down to which type of trader you are, but those who have a longer-term outlook will certainly recognizes opportunity. I believe that the so-called “smart money” has been entering this market for some time now, and now lot of the normal traders out there will have recognized the move as well. The real tell will be whether or not the market can take off in the early part of January, which will be when the larger amounts of money will come back into the marketplace. I believe that will happen, but between now and then pullbacks should offer nice buying opportunities as we continue to see bullishness enter this market. The fact that the WTI market can continue to go higher as the US dollar strengthens overall is a good sign as well.