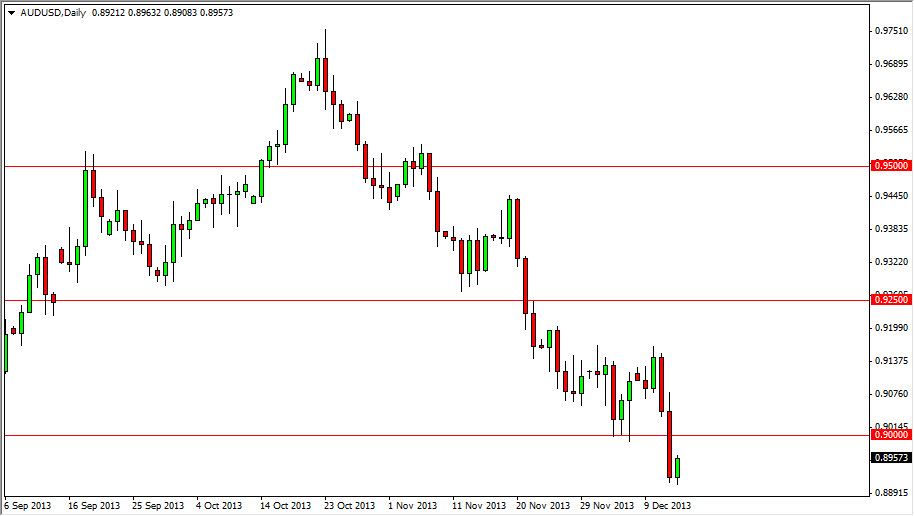

The AUD/USD pair rose during the session on Friday, as you can see, but at the end of the day we are still well below the 0.90 handle. When looking at this chart, there is a significant amount of support just below current pricing on a longer-term charts, but at the end of the day we have to look at the break down below the 0.90 level as significant. Because of this, I think that this pair will continue lower, and I would be more than willing to sell some type of resistive candle near the 0.90 level, and expect to see the market break down below the 0.88 level, and possibly as low 0.85 handle if we get that break down.

Watch the gold markets as well, because they are sitting right on top of the $1200 level, which of course is a massive supportive area. If that level gets broken down below on a daily close, it should send gold down to $1000, which will wreak absolute havoc on the Australian dollar itself. Pay attention to both markets, because one will typically leave the other, although there is no set rule to it - it's just a generality of the marketplace I have noticed.

Federal Reserve and tapering.

If the Federal Reserve does not taper off of the quantitative easing that it's been in, this pair will absolutely turned around and skyrocket to the upside. However, it appears the markets are starting to factor in the likelihood of tapering, and that is going to be good for the US dollar in general. The Australian dollar is extraordinarily sensitive to the price of commodities in general, and the "risk appetite" of global markets, and if the US dollar continues to strengthen, it will affect all commodities as they are generally priced in US dollars. Simply put, it takes more of those Dollars to buy those commodities. That drives the price of "stuff" down, and has a negative effect on the Australian dollar as it is representative of such a commodity laden economy.