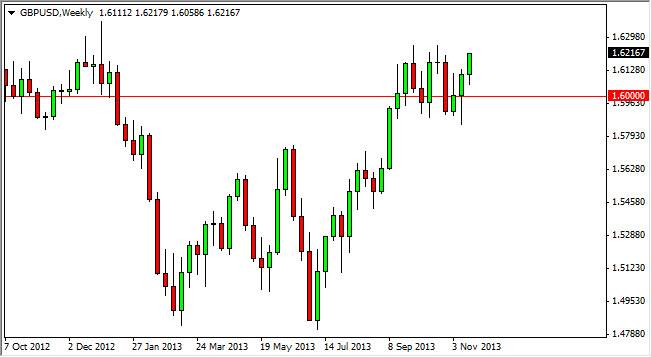

GBP/USD

The GBP/USD pair had a positive week as you can see on the chart, but it still remains below the all-important 1.63 resistance level. This level is the top of the recent consolidation, so while this pair is most certainly looking bullish, I cannot go long of it until that level is broken, at least on a daily close. This market should offer that move, or at least a pullback that could be bought as it could be a catalyst to build momentum in order to break out to the upside later.

Nonetheless, I am buying this pair, but it will come down to whether or not the market can get the momentum needed to go higher. The Federal Reserve will be watched closely as well, as the need or possibility to taper off of quantitative easing will be up front and center.

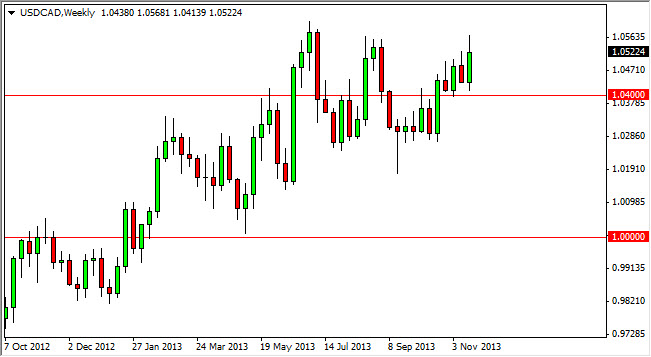

USD/CAD

The USD/CAD par rose over the course of the week, but still can’t get over the 1.06 level. This is the area that I need to see this market close above in order to go higher. In fact, if we get above it, I believe this pair can get as high as 1.10 in the near-term. The market could pull back just as I said in the GBP/USD pair, but in the end – I think this market is looking for the momentum as cable is as well.

Pay attention to oil, its always important to the value of the Canadian dollar as well. It looks a bit soft, and a serious breakdown in that market will send this pair much higher.

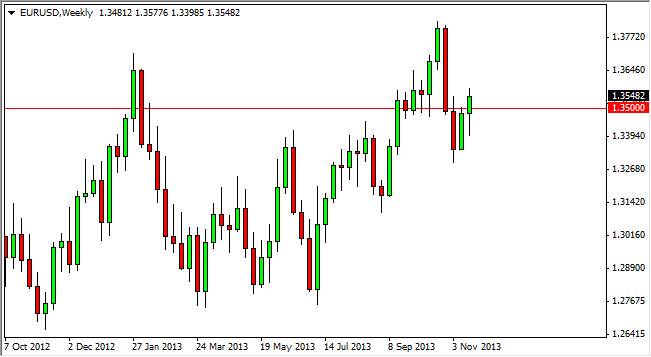

EUR/USD

The EUR/USD pair initially fell during the week, but eventually got the momentum to the upside to close back above the 1.35 level again. This market has now formed a hammer, which of course is a bullish sign. However, the market looks like it could be choppy in the near-term, so I am not as interested in this market as others at this point. Nonetheless, the market will be highly sensitive to the actions and words of the Federal Reserve, as well as the Europe Central Bank.

The pair will focus on the taper aspects in America of course, but the European economy will also be in focus, as the surprise rate cut has a lot of traders worried about what is going on in the EU. This market will continue to punish trades in my opinion, and as a result I think it is a more of a short-term trader’s market.

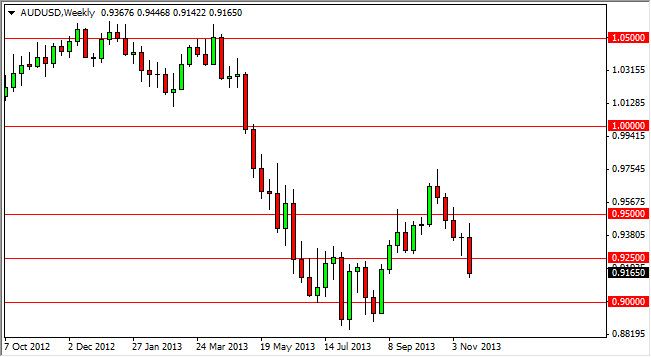

AUD/USD

The AUD/USD pair has finally broken down below the 0.9250 level, an area that I have been looking to see closed below. Because of this, I think this pair is going down to the 0.90 level fairly soon. I also believe that the pair goes all the way down to the 0.8850 level, the last area that the pair has bounced from. The gold market is also looking a bit soft, so this could propel the value of the Dollar also. This being the case, I think the pair is far too soft to go long.