EUR/USD

The EUR/USD pair fell during the balance of the week, closing below the 1.34 handle. This move was predicated by the surprise rate cut on Thursday out of the European Central Bank. Because of this, the Euro found itself on the back foot most of the week, and as a result this market looks like it's ready to grind lower. If we can break the lows of the week, I feel that this market is going to head down to the 1.31 handle, and possibly even lower than that. However, I do not anticipate this being a smooth move. On the other hand, if we get above the 1.3550 level on a daily close, that would be very pro-Euro.

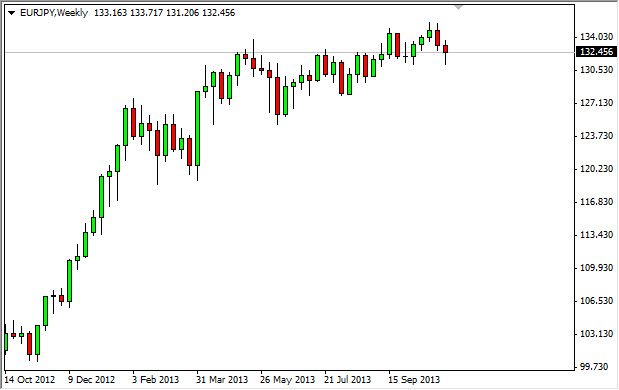

EUR/JPY

The EUR/JPY pair fell during most of the week as well, but got a boost on Friday after the nonfarm payroll numbers came out much stronger than anticipated. This brought on a "risk on rally", and because of this the pair bounced fairly well during the day. However, what has caught my eye is the fact that the market formed a nice looking hammer, only adding to the strength of the uptrend considering the fact that the ECB cut rates. With that being said, I am very bullish of this pair.

AUD/USD

The AUD/USD pair tried to break out to the upside during the week, but as you can see the 0.95 level offered enough resistance to push the market back down. That being said, we ended up forming a shooting star, and I believe that this pair will continue to go lower. On a break of the lows from the week, I think this market grind its way back down to the 0.90 level. The market has been bearish for some time now, and I believe that this market will continue the downtrend going forward.

USD/JPY

The USD/JPY pair fell during the first three days of the week, but as you can see the market bounced quite nicely, forming a hammer. This hammer of course suggests to me that the markets going to go much higher over the longer term. The market closed above the 99 level for the week, and as a result I believe this pair continues to go higher. If we can break above the 100 level, I feel that this market will go much, much higher.