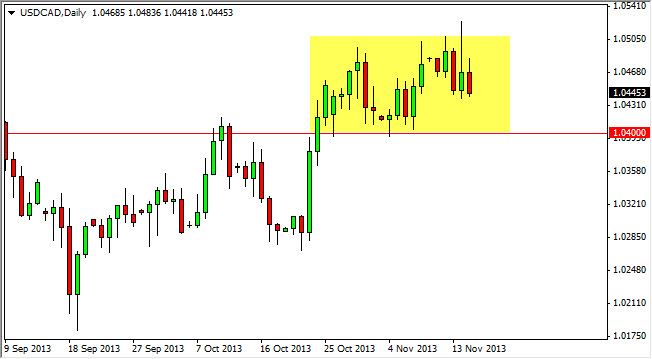

The USD/CAD pair fell slightly during the session on Friday, continuing to grind sideways as the pair typically does. One of the nuances about this pair that you have to understand is that the two economies are so intertwined that they tend to produce a very sideways currency market, only to see explosive moves in one direction or another. I do believe that this pair is going to go higher in the long-term, but I do believe that in the short term we could very well see a continuation of this consolidation that we've been in for the last couple of weeks.

All one has to stay attention to the oil markets understand that the Canadian dollar is going to have trouble being bid up at this point in time. After all, the Canadians are best known for exporting oil, and as the WTI Crude Oil markets seem to be soft to say the least, this will of course work against the value of the Canadian dollar. Nonetheless, Canada probably isn't going to complain too much about this exchange rate, as it does help with their exports to their largest partner, the United States.

Canada needs this exchange rate to go a bit higher, the Americans don't seem to care.

This is one of those situations where if the currency rate goes higher, it is a "no harm, no foul” situation. That being the case, I feel that this market will ultimately go higher, but we need to close above the 1.05 level on a daily close to head to the 1.06 level which is the next resistance area. Once we get above that area, things get truly interesting as we could hit the 1.10 level as well as there is no real resistance between 1.06 and there.

On the downside, I see a ton of support at the 1.04 handle, and extending all the way down to the 1.03 handle. With that being the case, I'm not interested in selling this pair, rather look at pullbacks as potential buying opportunities on signs of support in the general vicinity.