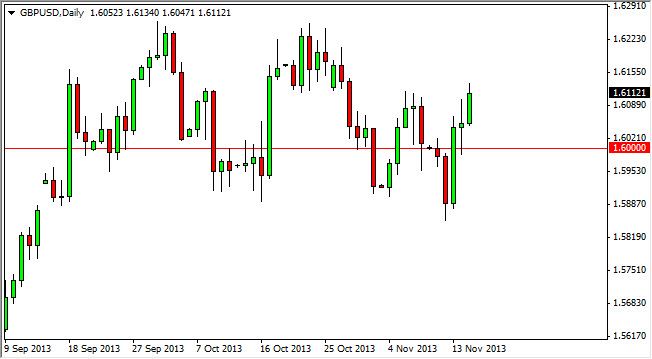

The GBP/USD pair rose during the session on Friday, breaking the top of the neutral candle that we had printed on Thursday. Because of this, I am bullish of this pair again, and do believe that the daily close above the 1.61 handle is somewhat significant. However, recognize the fact that we are still in consolidation, and I think that the 1.6250 level will of course be resistive. It is not until we close above the 1.63 handle that I feel completely confident going long in this market, but I do think that it will eventually happen, as we have been in a fairly strong uptrend previous to the month of September.

If we do pullback from here, I would fully expect to see the 1.5850 level, or above, offer enough support to keep this market afloat. Essentially, I look at this market is hovering around the 1.60 handle in general, trying to make a decision on which direction to go next. Typically, consolidation like this just leads to a continuation of the previous move, which of course was up.

Watch the Federal Reserve

Employment numbers will push the Federal Reserve in the direction of their next move, which will be to either taper off of quantitative easing or not. If they do, that will strengthen the US dollar overall, and that should have an effect on this pair. I would suspect that we could possibly break down the support at that point in time, but I think it's going to be a while before the Federal Reserve actually makes that move. On top of that, the British economy isn't exactly hurting, and there are signs that normalized monetary policy may come back into play.

On the other hand, if the Federal Reserve suggests that he cannot taper off of quantitative easing this market will go higher. If we can get a daily close above the 1.63 handle, I believe that this market goes to the 1.65 handle without too many issues. Above there, we could see a return to the 1.70 area, although you can expect that to be very choppy proposition.