Risk 0.50%

Enter short at 1.3650 if this price is reached between 08:00 and 14:00 London time today.

Stop loss at 1.3714.

Move stop loss to break even and take profit on half of the position at 1.3505.

This pair is likely to be the pair of interest in the market today, as there is high-impact news due on USD (Core Durable Goods Orders and Unemployment Claims at 13:30 London time).

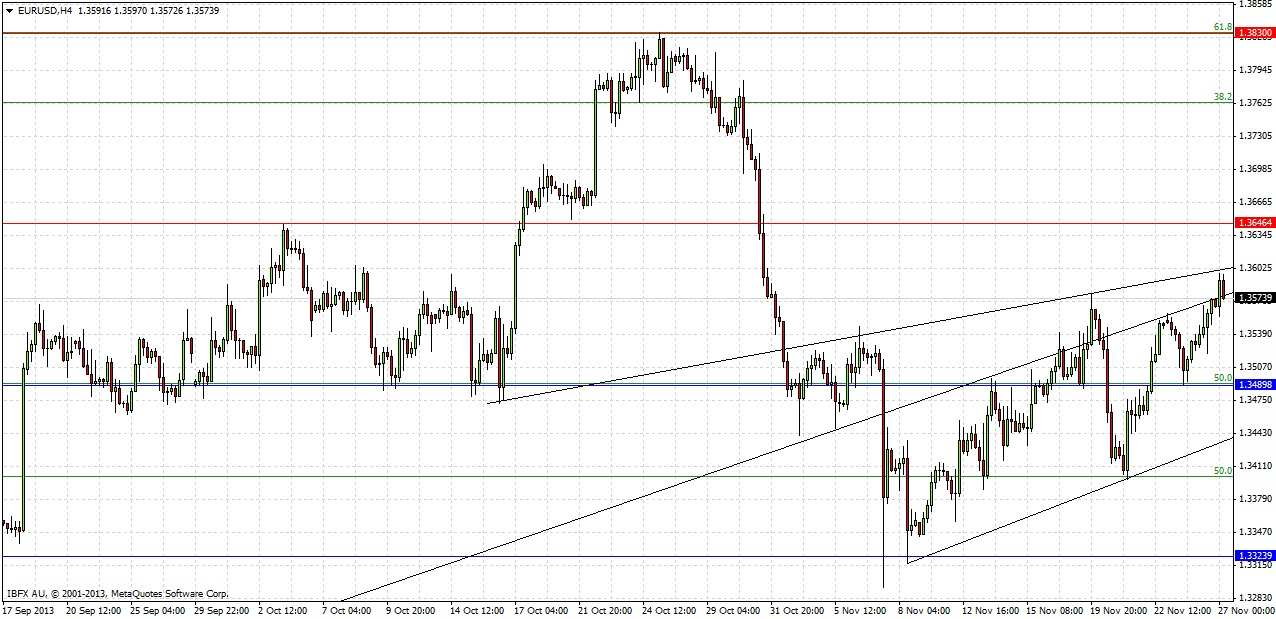

Technically, we are close to a zone around 1.3650 that has acted as both support and resistance during October. We are in a bullish ascending wedge and very close to its upper trend line. The medium trend line in the chart shown below is a long-term trend line:

Although the action has been bullish during the past two weeks and also over recent days, and we have just broken above the 50% retracement of the fall from 1.3830 to 1.3300 with a bullish engulfing candle on the daily chart, a false break of the upper trend line with a spike up to 1.3650 possibly driven by the news provides a good opportunity to short. It is possible the upper trend line will hold anyway, in which case the trade would not be triggered.

The 1.3650 level is 10 pips above the GMT R3 pivot, which can be expected to add to the probability of a short entered there before 14:00 London time.

The stop loss of 1.3714 has been selected as it is a little past the high of the localised price action on 18th October, when 1.3650 last came into play as an S/R level.

The initial take profit and breakeven level of 1.3505 has been selected as it has been support, a key centre of gravity, and is close to a key 50% Fibonacci retracement level. It is also within the ascending wedge marked the trend lines.