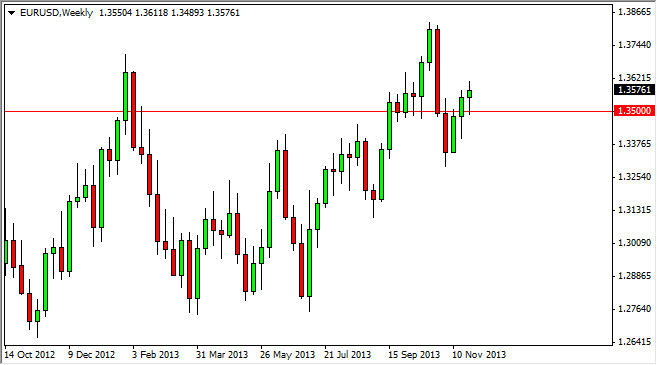

The EUR/USD pair is one that has been causing a lot of problems for longer-term traders these last few years. Quite honestly, I don’t see this changing anytime soon, and therefore the month of December will more than likely be a “tale of two markets” if you will, as I believe the choppiness continues, but there are also some nuances to the month of December specifically that will continue to weigh upon the pair as well.

The month of December tends to have two halves in a sense. The beginning of the month is much like any other one, but the latter half gets very illiquid as the trading community starts to get into the holiday mode. The Christmas and New Year’s holidays really takes a lot of trading firms away from the action, and as a result the markets can go days without doing much. However, there is a serious move during most Decembers as the markets will try to “square away” positions for the end of the year as managers will have to show their profits to clients.

Federal Reserve expectations and the European Union economy.

The Federal Reserve is still front and center as the world is still trying to figure out whether or not they will be able to taper off of quantitative easing. If they do – the pair will fall apart. However, they aren’t going to be doing it in the month of December. The market looks ahead by at least six months though, so don’t be surprised if we get that move previous to any real hard evidence of tapering.

The jobs numbers out of America will continue to push the pair around as well, with stronger numbers favoring the Dollar. This is because the Federal Reserve will be closer to tapering with each strong indication out of the labor markets. The November non-farm numbers will be crucial.

European Union economic numbers are important as well, as the surprise rate cut had a lot of traders off guard. The stronger than expected German numbers lately has the market thinking that the ECB is done cutting though. However, all of that being said – I think we remain in a range for the month. The 1.33 – 1.36 range is what I am thinking, but recognize the fact that the pair breaking above 1.36 sends it to the 1.38 handle.