EUR/USD

The EUR/USD pair rose during the week, breaking all the way up to the 1.38 handle. Because of this, it's obvious to me that this market is going to continue higher, and will more than likely find buyers on the pullbacks. That being the case, we should continue to see the Euro rise over time, as the US dollar will suffer at the hands of the Federal Reserve and its inability to taper off of quantitative easing. That being said, a break of the highs from the week is also a buy signal.

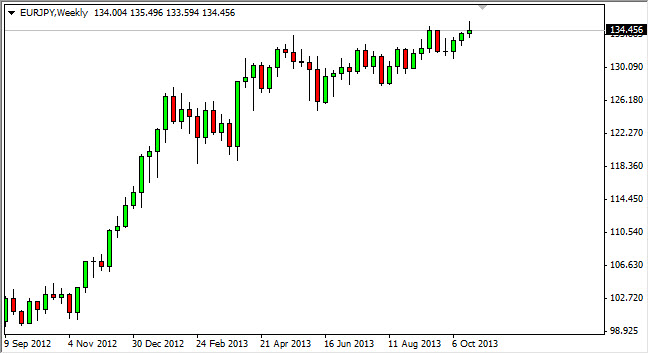

EUR/JPY

The EUR/JPY pair tried to rally as well, but as you can see failed to hang onto the gains, forming a shooting star. While the shooting star looks relatively weak, I don't necessarily think that there's anything massive about to happen. In fact, this is probably going to be a buying opportunity, and if we can see some type of supportive candle below, we should be ready to step on the gas as this market continues to go higher.

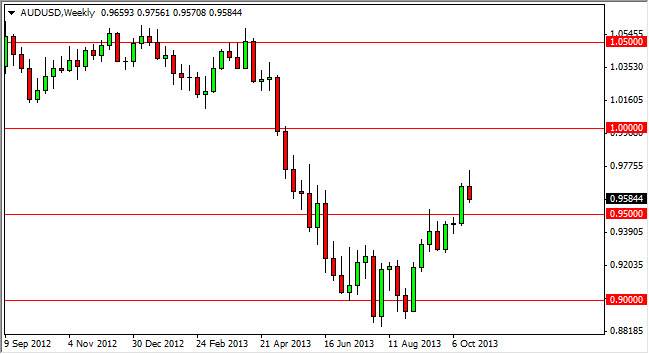

AUD/USD

The AUD/USD pair attempted to go higher during the week, but as you can see it failed somewhere near the 0.9750 area, and pulled back enough to form a shooting star. The biggest problem with this sell signal is the fact that it sits just above the 0.95 handle, an area that I fully expect to be supportive. Because of that, I am going to ignore this shooting star and buy a supportive candle at lower levels.

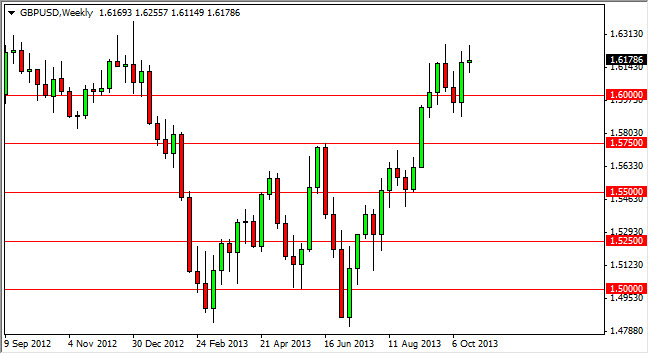

GBP/USD

The GBP/USD pair went back and forth over the course of the week, closing just barely positive. This candle looks a bit confusing, and kind of shooting star like shape, we which of course makes it a very sign. This pair sign though probably indicates that there is more of a pullback coming than anything else. With that being the case, I'm actually waiting to see if we get a pullback in a supportive candle that I can start buying, or a break above the 1.63 handle, which signals that this pair is ready to move to the 1.65 handle.