The previous analysis on Monday last week can be summarized as follows:

1. The general overall bias is bullish, until a daily close below 1.0250

2. Long trade recommended at 1.0268 for aggressive traders, provided this level is reached before 1.0355

3. First daily close beyond either of the levels outlined in 2. will determine likely direction of next major move

4. Support is at 1.0268 and there are resistance levels at 1.0339 and 1.0355

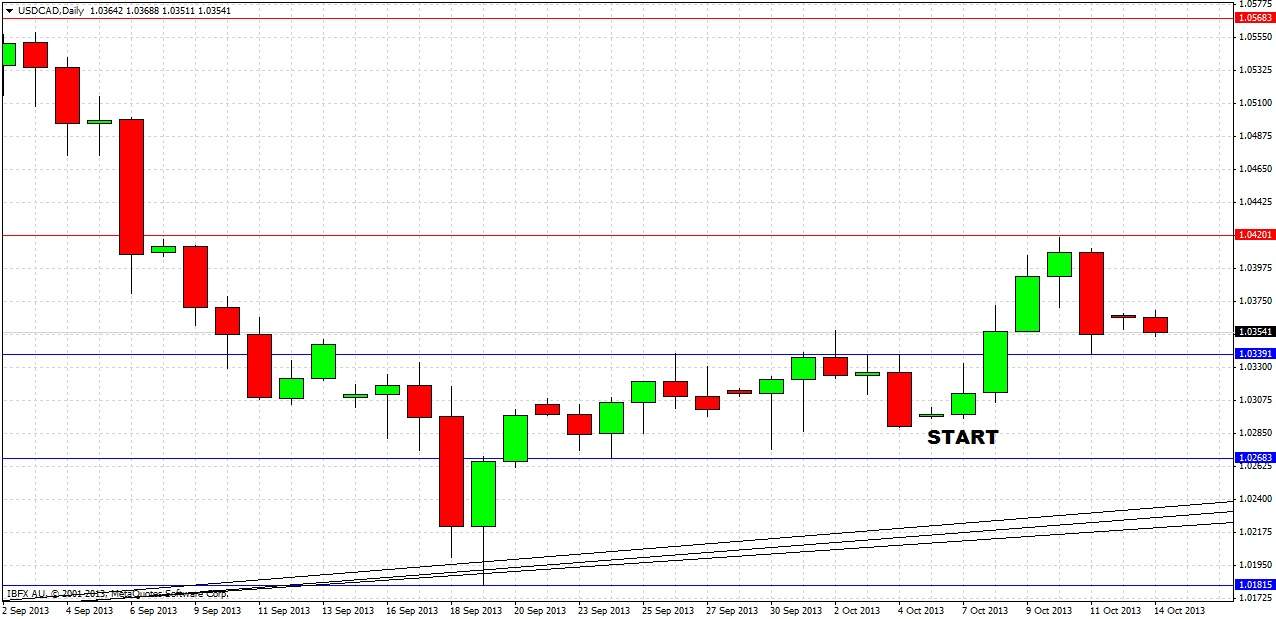

Let's look at the daily chart since then to see how things turned out

The bullish outlook was correct, price rose for four consecutive days after the last forecast. The price never pulled back to 1.0268, and there was a daily close just on 1.0355 that led to a further move up of 63 pips. The price has been falling since last Friday but is higher than it was at the time of the last forecast one week ago.

Turning to the future, let's start by taking a look at the weekly chart

The long-term upwards trend is still entirely intact. Last week was a bullish reversal candle, but it only closed about halfway up its range, so it is not a very reliable bullish sign. This chart does not tell us much else, except that last week’s high at 1.0418 might prove to be fairly strong resistance at it coincides with the overlap zone between the two large consecutive bearish weeks in August.

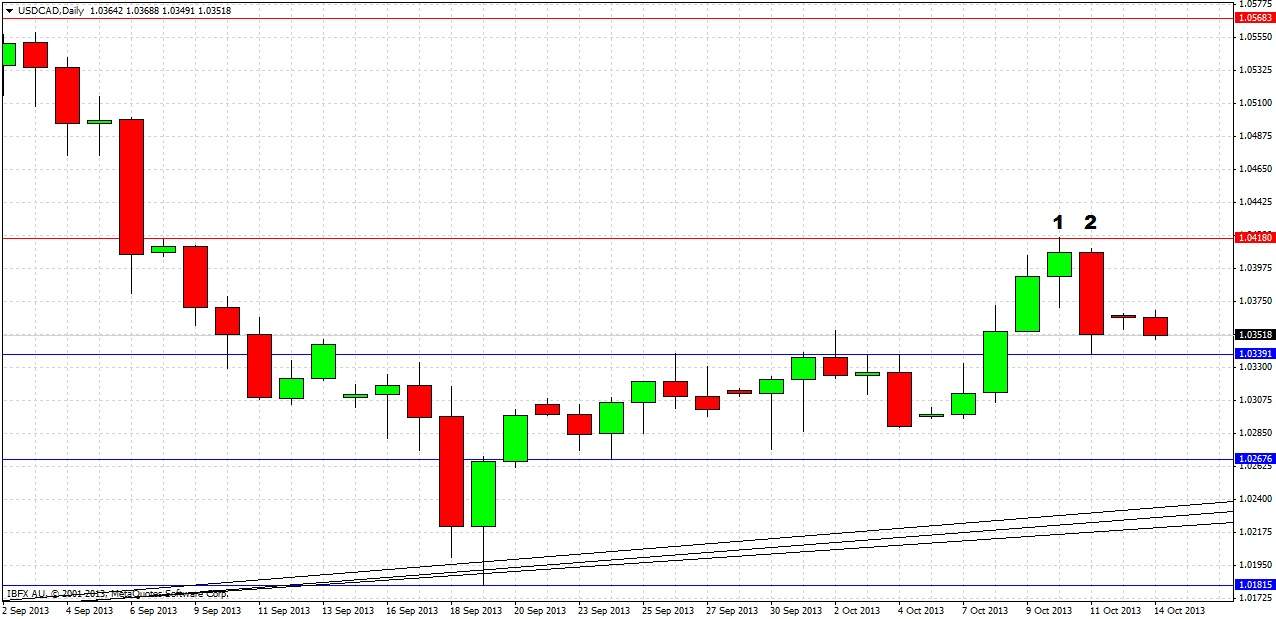

Let’s take a closer look now at the daily chart:

Last week the price rose strongly to the weekly high on Thursday (marked at 1), before falling quite sharply on Friday to form a bearish reversal candle (marked at 2). The previous resistance level below at 1.0339 seems to have turned into support, with price bouncing up 30 pips from that level so far.

If the support at 1.0339 is not broken today, that will be a sign that the upwards trend may be ready to resume.

The long-term upwards trend is still intact and 1.0268 still looks like a good level to buy at, especially if price reaches it when this level is confluent with the bullish trend lines.

In the short-term, a fast retest of last week’s high at 1.0418 could be a good opportunity for a short.

Overall bias is still bullish due to the intact bullish trend lines, but bear in mind that over the summer a bearish double top was made that calls into question whether this trend has much further to run.