By: Simit Patel

As the US government shuts down, there has been an increasing amount of chatter regarding gold -- an asset traditionally regarded as a hedge against breakdowns in government. In this article, we'll take a look at what the gold charts are telling us on various timeframes, and what traders may wish to consider when forecasting its price.

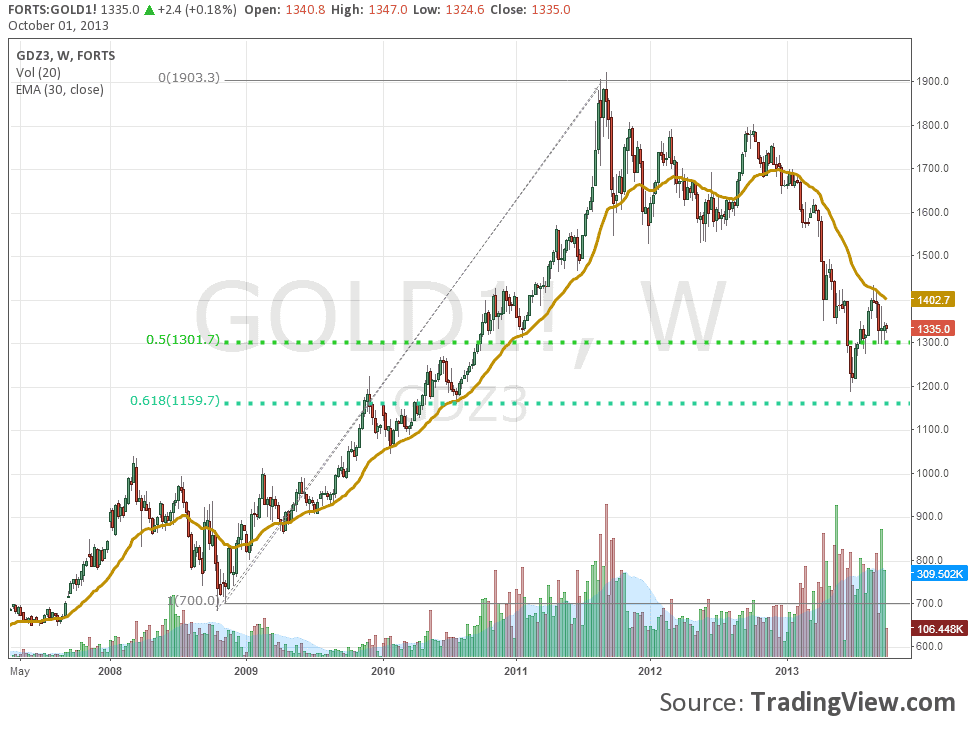

Major Fibonacci Levels Are Holding on the Weekly Chart

First, it is worth noting that the dip below $1,200/oz to start July marks price touching the 61.8% Fibonacci retracement level from the October 2008 lows to the highs reached in August/September of 2011. Since price touched the 61.8% Fibonacci level, gold has rallied, and is currently holding above the 50% Fibonacci level of the aforementioned October 2008 - August/September 2011 rally -- which is at approximately $1300. That hammer patterns are forming off that support level on the weekly chart are also something bulls should find encouraging.

Below is a weekly chart of gold.

The run up from $700 to $1,900, as well as the pullback to the 61.8% retracement level at circa $1200, sets the stage nicely for forecasting price and time via an AB=CD movement. Under this formation, we can add the distance from point A ($700) to point B ($1,900) -- which amounts to $1,200 -- to point C, which is the retracement level at $1,200. This gives us a price target of $2,400. Since the move from A to B took about 23 months, we can expect the same for the move from C to D -- which would suggest a $2,400 price is reached in the summer of 2015. If this goal is to be achieved, a reasonable next step would be to clear the 200 daily EMA sitting just above $1,440 at the moment.

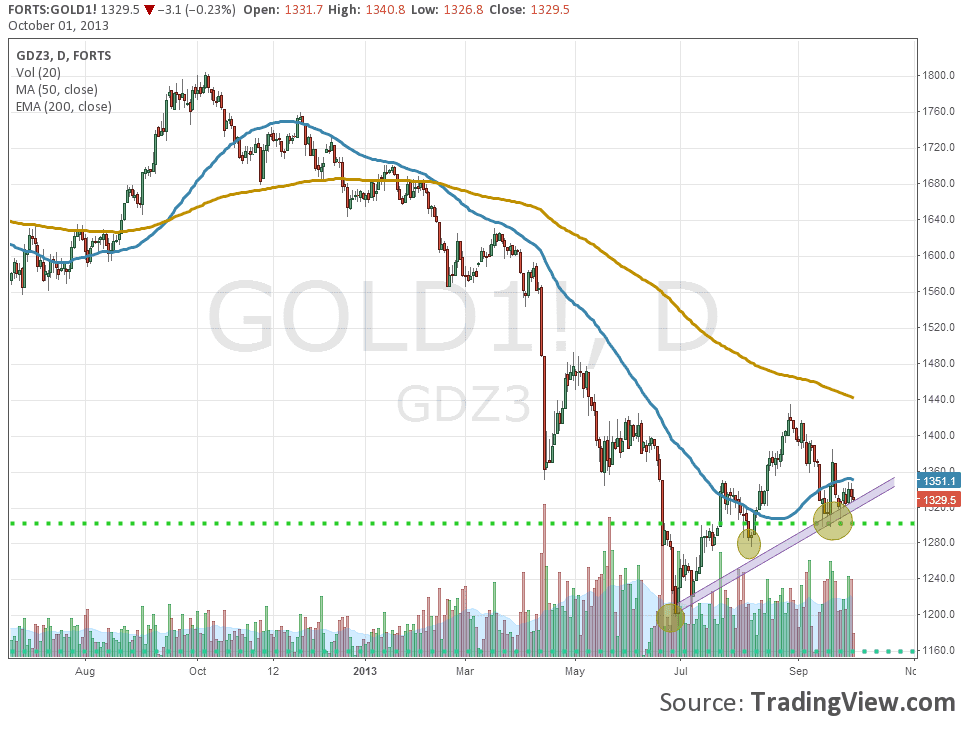

Price Approaching 50 SMA On Daily Chart

If we zoom in to the daily chart, we see some additional signs of bullish price action, suggesting a move upwards -- perhaps to the $2,400 price target identified by by the AB=CD pattern -- may be in the cards. Specifically, we see a pattern of higher lows forming, as well as a tentative upward trendline going back to the July 2013 lows. An important time is upon us as price closes in on touching the 50 day simple moving average; clearing this level could pave the way for many more automated trading systems to open up to signalling buy orders.

The chart below illustrates.

Based on these technical factors, patient bulls may be interested in building a gold position to hold until at least the summer of 2015. If the trendline highlighted on the daily chart or the 61.8% Fibonacci level noted on the weekly are breached, though, the trend may be invalidated.

Simit Patel is a currency trader who has been trading the forex market live since 2005. He is primarily a price action trader, relying on a blend of support/resistance analysis, Fibonacci levels, and moving averages to determine entry and exit points, though he does also make long-term investments in other assets classes -- mainly stocks -- based primarily on valuation analysis. In 2008, Patel co-founded InformedTrades.com, an online community dedicated to helping individuals learn to trade the world's financial markets.