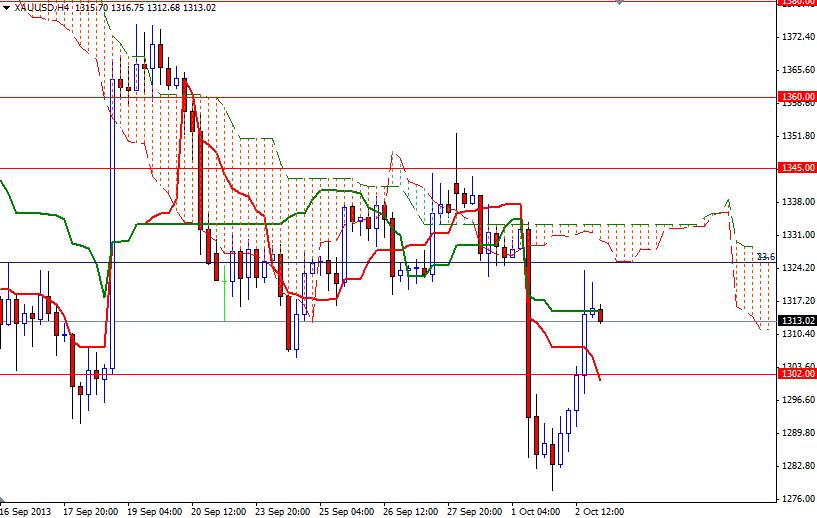

The XAU/USD pair bounced off of the 1275 support level and traded as high as 1323.84 as soft economic data out of the United States lead some investors to shift money from equities to gold. Data released by the ADP Research Institute revealed that private sector added just 166000 jobs in September, less than expectations of 180000. Gold also drew strength from speculations that Democrats and Republicans will struggle to reach an agreement on the nation’s budget.

Yesterday, Republican speaker of the U.S. House of Representatives, John Boehner said President Obama refused to negotiate in a meeting with congressional leaders about reopening the government and stopping the harm the shutdown is causing to the economy. I think the U.S. debt limit is far more important than the shutdown because it could have significant implications for economic growth. It appears that politics will dominate market sentiment for the next couple of weeks.

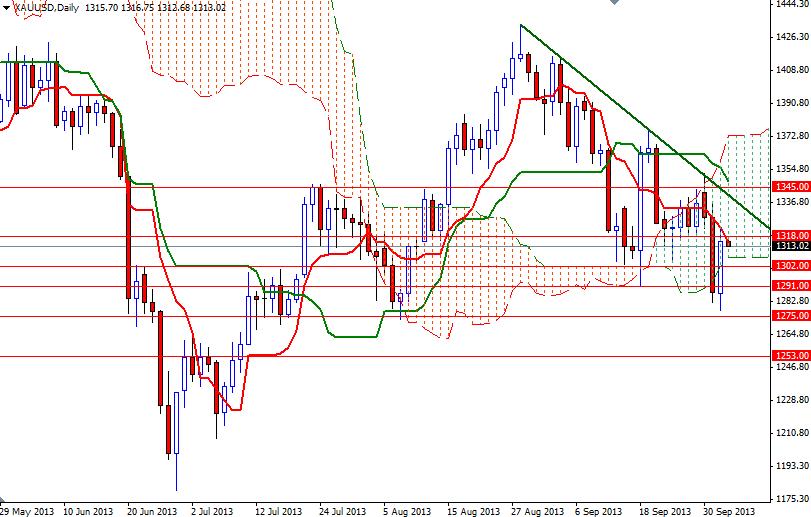

Although the broader directional bias remains weighted to the downside, I wouldn't ignore the fact that there is a possibility that gold prices will climb higher to retest the 1318 resistance. However, on the daily chart, there is a descending trend line which resides inside the Ichimoku cloud around the 1345 level so I believe that will be a tough challenge for the bulls if we can reach there. If the bullish momentum continues and 1345 gives way, I will be looking for 1360 and 1373.15. If the bears successfully defend the 1318 and prices continue to fall, expect to see some support at 1302.

Short term charts suggest that a retest of 1291 and 1275 is likely if the 1302 support is broken. Headlines regarding the U.S. budget negotiations will be the main driver of the precious metal's performance.