Gold prices fell sharply during yesterday's session and closed the day at $1287.66 an ounce. Breaking below the critical 1318 support level triggered a sell-off which gained some more momentum after manufacturing activity data released from the Unite States provided further evidence that the world's biggest economy is continuing to recover.

Data released from the Institute for Supply Management showed that the index of national manufacturing activity climbed to 56.2 from 55.7 a month earlier. The reaction of markets to the partial shutdown of the U.S. government was muted. There is a growing conviction that the shutdown will not last long and I think this calmness comes from the fact that investors have seen this political drama before.

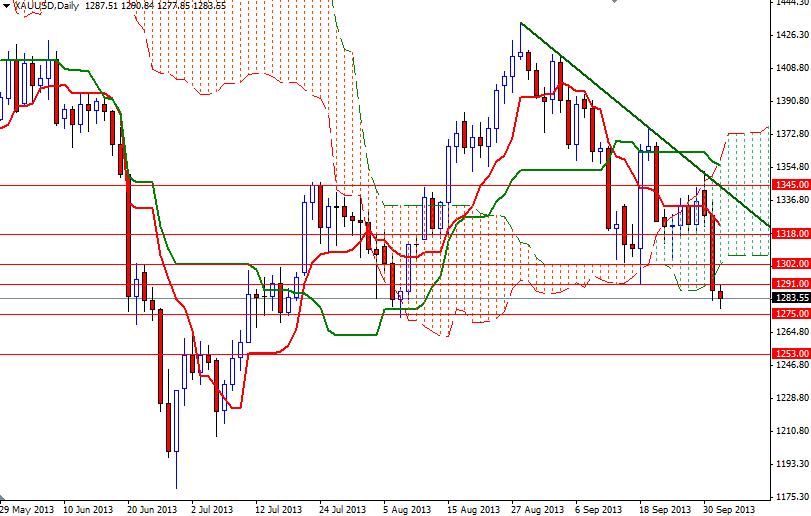

Today, during the Asian session, the XAU/USD pair fell to a seven-week low of 1277.85 before recovering to 1283.55. Since gold prices found both support and resistance around the 1275 level in the past, it is likely that we will see some profit taking at that point. If that is the case, expect a rebound towards the 1302 - 1305 zone where the Ichimoku clouds reside on the daily time frame. If the bulls manage to push and hold prices above this area, we might revisit the 1318 level before heading lower.

As I told in my previous analysis, until prices climb above the 1345 level, I have no intention to go long. If the bears increase the downward pressure and the XAU/USD pair closes below the 1275 level, I think the next stop will be 1253. Once below that, the bears' new targets will be 1244 and 1236. Today market participants might wait for the ECB press conference and Non-Farm Employment Change report from ADP Research Institute before putting larger bets.