Gold prices fell for the week as investors continued to price in the Federal Reserve’s possible trimming of its massive stimulus later this year. The XAU/USD pair has seen quite a selloff recently as the market conditions (both technically and fundamentally) have been working against gold. Growing optimism that President Obama and Republican leaders will end the partial U.S. government shutdown and extend the government's borrowing authority weakened demand for safe-haven diversification.

It seems that market players don't need disaster insurance at the moment. In the latest economic data, University of Michigan's preliminary index of consumer sentiment came in at 75.2, down from the previous month's 77.5 but more or less in line with market expectations. The XAUUSD pair fell to its lowest level in thirteen weeks after the bears managed to drag prices below the 1275 support level which had been an important bottom in the past. Gold traded as low as 1261.89 before recovering slightly to 1270.02.

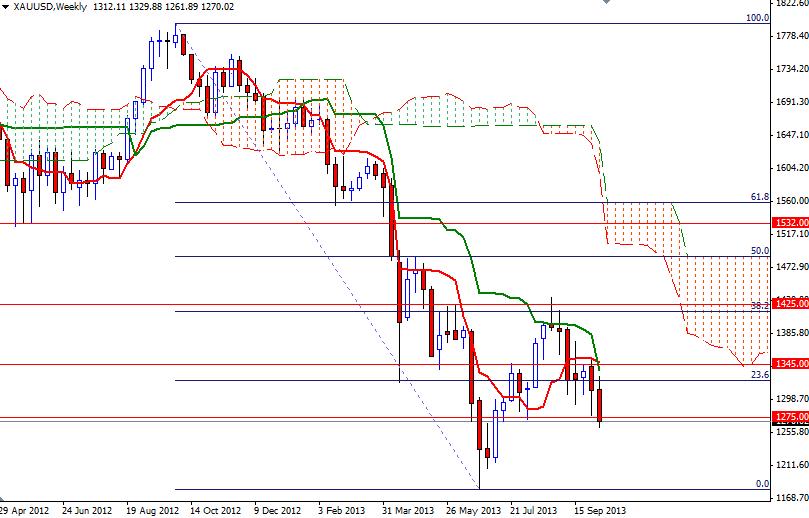

In my previous analysis, I repeated that prices will continue to remain under the bearish pressure and buying gold is not an option while trading below the 1345 level. I think the price action on the daily chart confirms that the bulls will have more strength and volume in the short term. In addition, the XAU/USD pair is trading below the Ichimoku clouds on the weekly, daily and 4-hour time frame.

To the downside, I think the 1260 -1253 zone will be the first support for the bulls. If we drop below the 1253 level, it is likely that the pair will be testing 1244 and 1236 soon after. A close below the 1236 support level could accelerate downward movement. In order to ease selling pressure, the bulls will have to capture the first strategic fort at 1302. Beyond this level, there will be resistance at 1313 and 1326. Only a close above 1326 could give the bulls the extra strength they need to retest the 1345 level.