Although the XAU/USD pair started the week higher on signs that U.S. policymakers are struggling to avert a temporary government shutdown, the pair failed to break through the 1345 resistance and pulled back to the Fibonacci 23.6 level (based on the bearish run from 1795.75 to 1180.21). Despite a combination of gold supportive factors such as, political turmoil in Italy, Fed's willingness to maintain its massive stimulus, concerns over the U.S. government budget and the debt ceiling impasse, prices have been suffering due to weakening demand.

Since Chinese gold consumption plays an important role in this market, disappointing economic numbers from China are weighing on gold prices as well. According to the report released by HSBC, the index of manufacturing activity slipped to 50.2 from 51.2 and the China Federation of Logistics and Purchasing said that the official Purchasing Managers' Index rose to 51.1 from 51.0. So far gold bulls have been doing a good job to protect the 1381 level but they don't seem to have the strength to reverse the trend as the uncertainty over the U.S. budget talks make gold traders reluctant to take sizable positions.

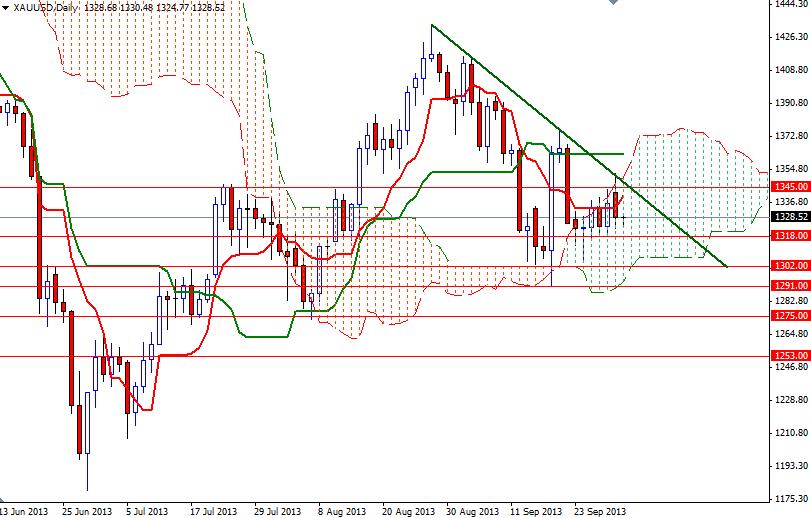

The XAU/USD pair is stuck inside the Ichimoku cloud (on the daily time frame) and technically this means the price action will be limited until we manage to leave this area completely. To the upside, there will be resistance between the 1345 and 1360 levels.

Only a close above this level could make me think that the bulls are strong enough to tackle 1380. If the bulls run out gas and fail to penetrate the first barrier, 1318 will be the key to the downside. Breaking below the 1318 support level would indicate that the bears won't give up before we revisit the 1302 level.