Gold prices (XAU/USD) settled slightly lower yesterday as investors took a cautious stance ahead of the U.S. Federal Reserve's monetary policy announcement. The XAU/USD pair traded as high as 1361.76 after a report released by the National Association of Realtors revealed that sales of previously owned homes decreased 5.6% in September. Separately, data released by the Fed showed that industrial production advanced 0.6%.

The economic recovery is somewhat weaker than the Fed's forecasts and because of that the American dollar has been heavily influenced by weakening data. While disappointing figures reinforce expectations that the Federal Reserve will delay scaling back its asset purchasing program until spring, I think this market as more of an upward bias in the short term.

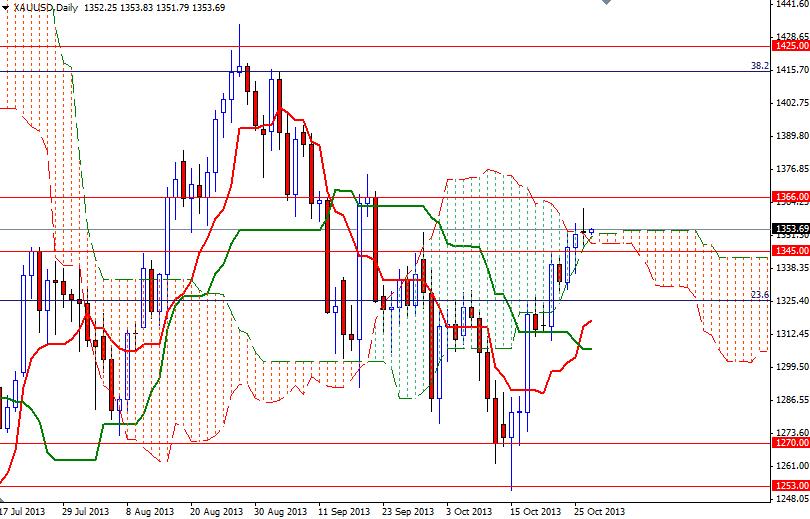

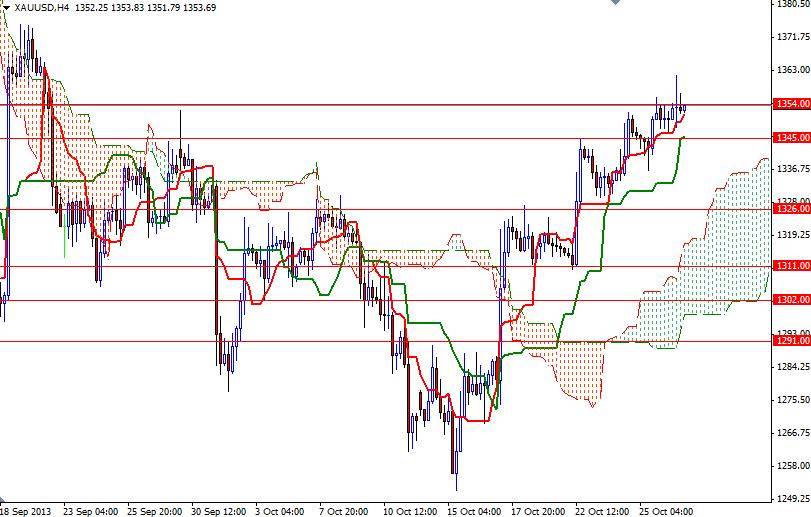

Technically speaking, trading above the Ichimoku cloud on the daily time frame is positive for gold prices and I have no intention of opening a short position unless we close under the clouds and the Tenkan-sen (nine-period moving average, red line) crosses below the Kijun-sen line (twenty six-day moving average, green line) on the 4-hour chart. Of course, that doesn't mean that prices won't pull back. In the meantime, until the FOMC announcement, I think we will remain between the 1366 and 1345 levels. If the bears can increase selling pressure and shatter this support, it is very likely that the pair will revisit the 1335 level next.

A close below this level would suggest that the 1326 level which happens to be the Fibonacci 23.6 based on the bearish run from 1795.75 to 1180.21 might be the new target. However, climbing above the 1366 level would lure some investors back into the market and increase the possibility of a bullish attempt to revisit the September 19 high of 1375.20. Beyond that, an important challenge will be waiting the bulls in the 1380 – 1392 area.