The XAU/USD pair (Gold vs. the American dollar) produced a bullish candle as the American dollar lost strength across the board during yesterday's trading session. The pair traded as high as 1344.65 after a report released by the Labor Department showed that unemployment rate fell to 7.2% but the U.S. economy added only 148K jobs in September, well below expectations of 180K. Since Federal Open Market Committee members have been clear that the central bank will not change its policy until the outlook for the jobs market has improved substantially, poor data stoked speculations the Federal Reserve will maintain its $85 billion monthly asset purchases until next year to hasten economic recovery.

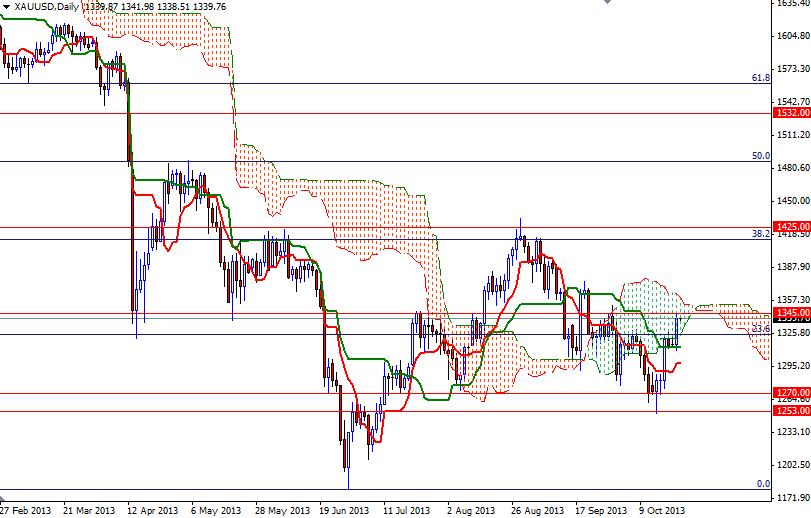

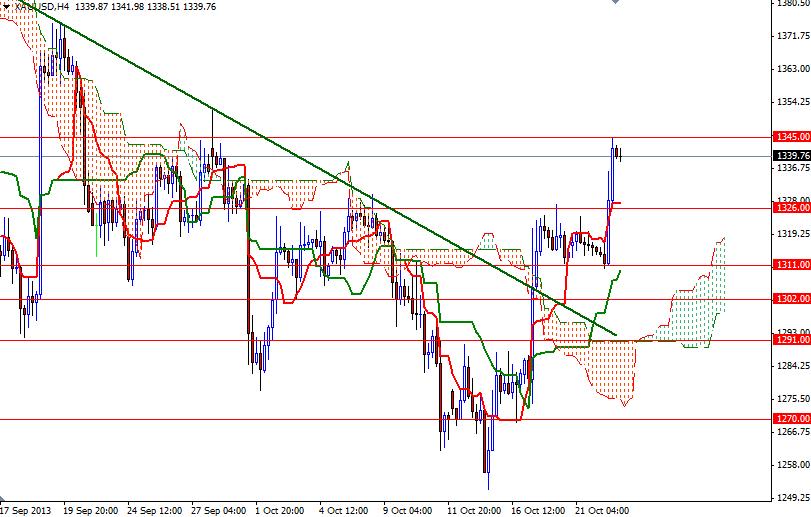

As I mentioned in my previous analysis, buyers will be taking advantage of weak economic indicators which suggest that the U.S. economy is losing momentum. Charts also paint a similar picture. Currently the XAU/USD pair is trading above the Ichimoku cloud on the 4-hour time frame and the Tenkan-sen line (nine-period moving average, red line) is above the Kijun-sen line (twenty six-day moving average, green line).

Today the 1345 resistance level will be the key zone to watch because the XAU/USD pair has paused or reversed at this same price level several times since April. A close above this level could increase buying pressure and would give the bulls a chance to march towards the 1366 resistance level. On its way up, expect to see resistance at 1354. If the bears manage to defend the critical 1345 level and prices reverse, support can be found at 1331.20, 1326 and 1311.