By: DailyForex.com

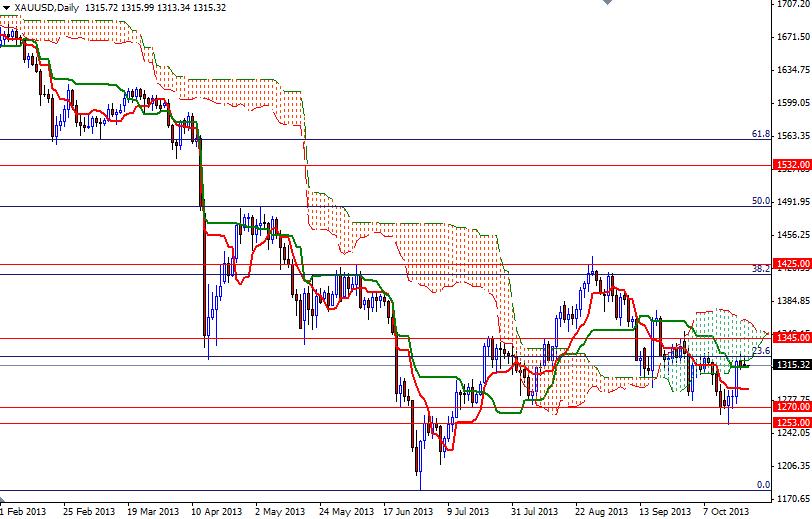

Gold prices (XAU/USD) settled slightly lower yesterday as the 1326 level, where the bottom of the Ichimoku clouds on the daily chart resides, continued to offer resistance. Today the markets will focus on the U.S. nonfarm payrolls report and unemployment rate. Data had been delayed due to the 16-day government shutdown.

The XAU/USD pair has been consolidating roughly between 1326 and 1311 since Friday. Tightening trading range indicates that investors are reluctant to make aggressive bets ahead of a key event which the Federal Reserve watches carefully. Federal Reserve Bank of Chicago President Charles Evans, who is a voting member of the Federal Open Market Committee, said “It’s very difficult to feel confident in December given that we’re going to repeat part of what just took place in Washington. We need a couple of good labor reports, and evidence of increasing growth, GDP growth, and it’s probably going to take a few months to sort that one out” in an interview yesterday.

The Federal Reserve’s last two meetings this year are scheduled for October 29-30 and December 17-18. While conditions in the job market are still far from what policy makers would like to see, I highly doubt that they would reduce the pace of asset purchases before 2014. Although the Fed's easing policy tends to be supportive for gold, demand is another crucial element shaping price movements.

On the 4-hour chart, we have a bullish Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-day moving average, green line) cross and the pair is moving above the Ichimoku cloud. However, on the daily chart, the 1326 resistance is blocking the bulls' advance. That means a retest of 1345 is likely if the 1326 level is cleared. I believe that the 1345 resistance will be a tough challenge for the bulls but if the pair breaks through, the next stop would be 1354 - 1365 area. To the downside, there will be support at 1311 and 1302. Breaking below 1302 would make me think that we are heading back to the 1291 level.