Last week the XAU/USD pair traded as high as 1327.05 after a deal passed by both houses of Congress to raise the U.S. borrowing limit. Although U.S. lawmakers managed to avert a debt default by a last-minute deal, lack of deficit reduction measures means we will probably see the same political games again in February 2014.

Until then the gold market will be speculating that the Federal Reserve will not change its aggressive easing stance in the near future. In the meantime, there will be concerns over the negative impact of the shutdown on the U.S. economy and of course economic numbers which has been affected by recent doubts will weigh on the American dollar. With that in mind, I think the bulls will be taking advantage of this situation and try to push prices higher in the short term, as they did back in January (right after the U.S. avoided the fiscal cliff).

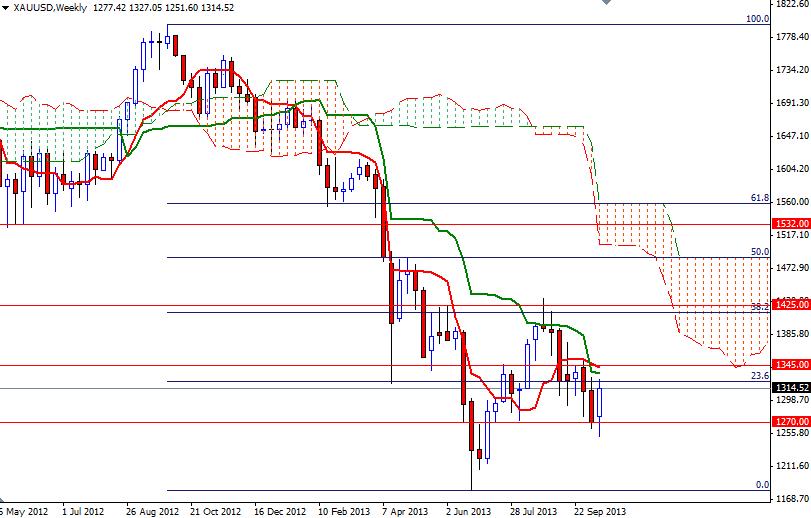

In my previous analysis, I had said that climbing above the 1291 - 1302 zone would change the technical outlook and give the bulls enough power to reach the 1326 level. The pattern on the daily chart and the fact that prices broke above the descending trend-line originating in August suggest that higher prices will come. However, the 1326 level which happens to be the bottom of the Ichimoku cloud on the daily time frame coincides with the Fibonacci 23.6 level so breaking through this barrier is essential for a bullish continuation.

If that is the case, expect to see resistance at 1345, 1354 and 1365. If sellers step up pressure and prices reverse, we may pull back to 1302 (or even 1291) before the bulls attempt a new rally. A drop below 1291 would place control back in the paws of the bears as we head towards the 1270 support level.