Our analysis last Thursday ended with the following predictions:

1. A strong bearish bias.

2. Long-term traders can go short at 1.5915 with a stop loss above 1.6119.

3. Shorter-term traders can go short after some kind of pull-back.

4. A break of 1.6119 to the upside before a break of 1.5915 to the downside will invalidate the strong bearish bias.

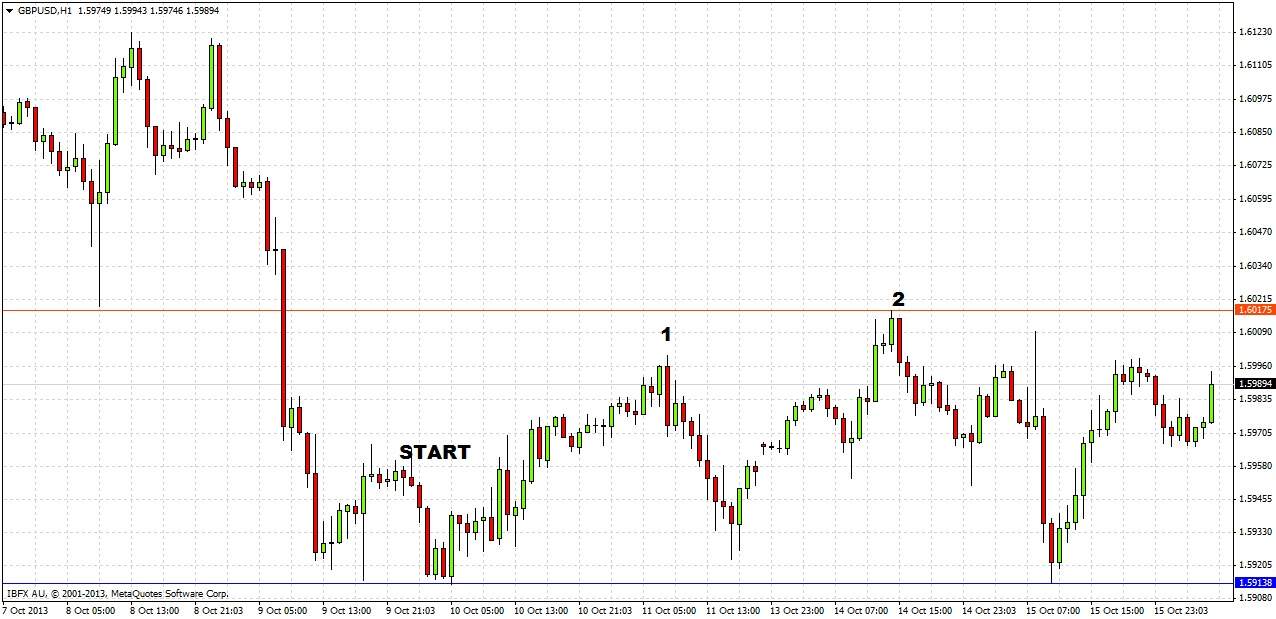

What actually happened is that the price did break 1.5915, but only by a pip or two. The price then rose, before falling, then rose and fell again, as we can see from the 1 hour chart below:

The bearish bias, so far, has not been justified. However, the jury is still out for any long-term traders short at 1.5915 with a stop loss above 1.6119. Short-term traders would have had two opportunities to take profitable short trades: there was a bearish reversal outside candle marked at (1) and a more profitable one marked at (2). The one at (2) was immediately following a near first retest of the low of 1.6019 made on 8th October.

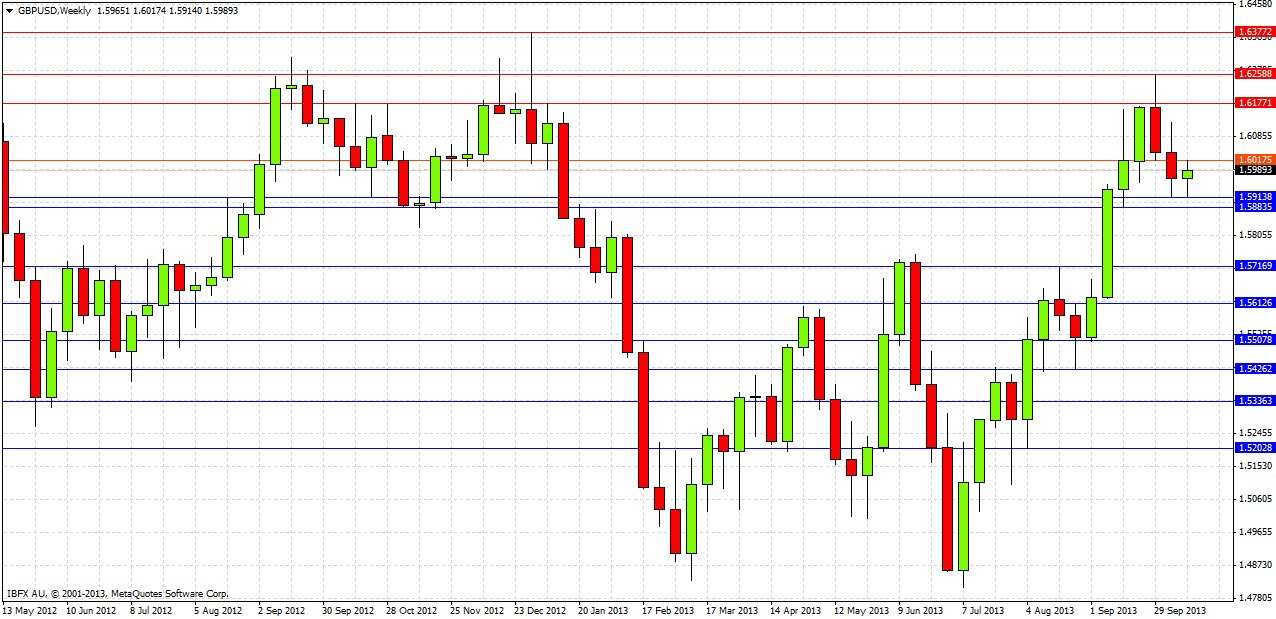

Turning to the future, let's start by taking a look at the weekly chart

Last week was a bearish candle that closed in its lower half. What is most striking about the weekly chart is the strength of the uptrend. It is unusual for such a strong trend to reverse very quickly, which is why traders favouring shorts are probably best served by being prepared to be patient and long-term with any short trades right now. It might well be difficult to capture the true beginning of the move down with a very low risk in terms of pips.

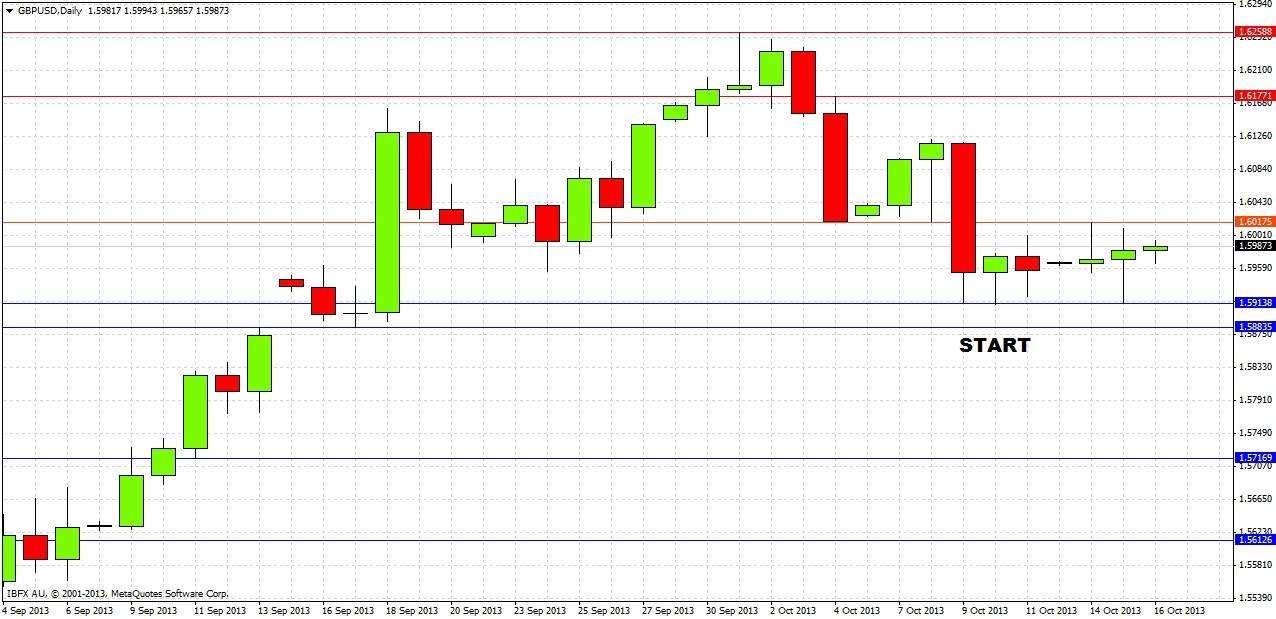

Let’s turn to the daily chart now for a more detailed look:

We can see that the action has been rather quiet since the sharp downwards moves of the previous two weeks. There are contradictory messages coming from the chart as to whether the expected continuation downwards is going to happen or not. The facts that the moves up have been very small in comparison with the moves down, and that the price has not managed to retrace even halfway back up the last large bearish candle to levels above 1.6019, suggest that it is still correct to hold a bearish bias. However, the facts that the price has barely managed to break the low of 1.5915, and that this support has held for almost an entire week including two retests, call such a bearish bias into question.

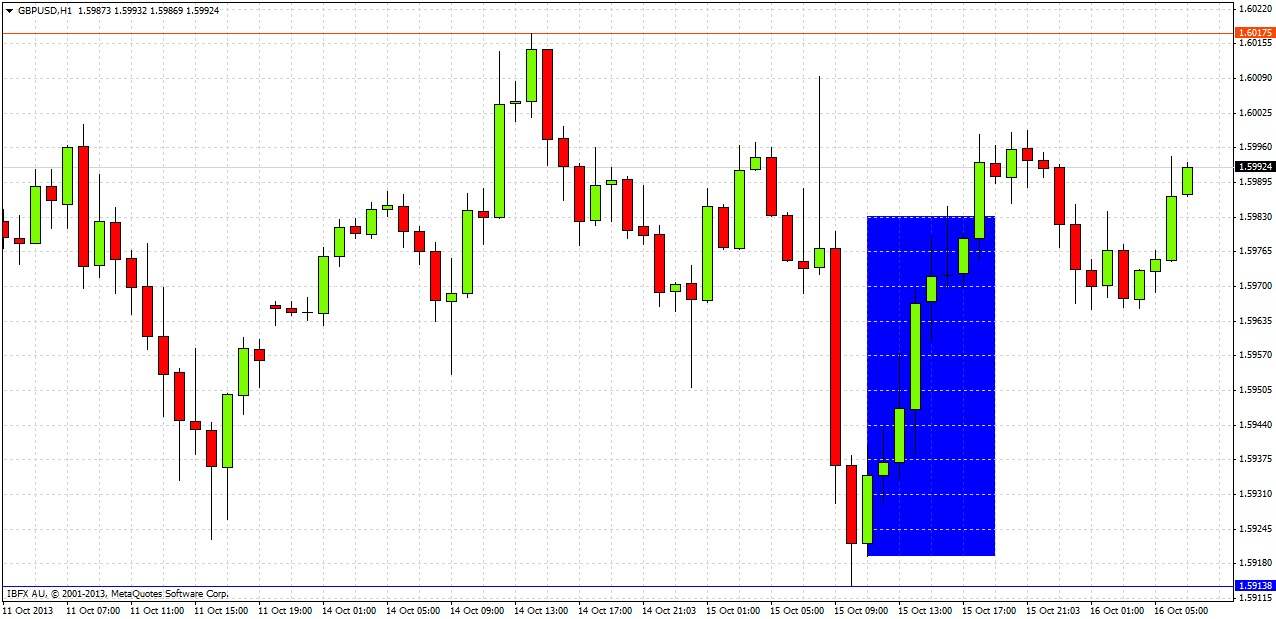

Taking another look at the 1 hour chart, note the smooth and fairly strong buying action yesterday from the support at 1.5914, highlighted in blue. This reveals demand, and is persuasive in reversing the previous bearish bias.

It makes sense now to close any long-term short trades, and wait to see whether the price will next strongly break 1.6018 to the upside or 1.5915 to the downside, re-entering short on any serious breakdown. Either is quite possible. It seems likely there will be greater potential in any downside move, but it also seems quite likely this pair is not ready to fall just yet. It is possible that there will be further profitable short-term short trades from 1.6018 and from the area around 1.6150 in the meantime.