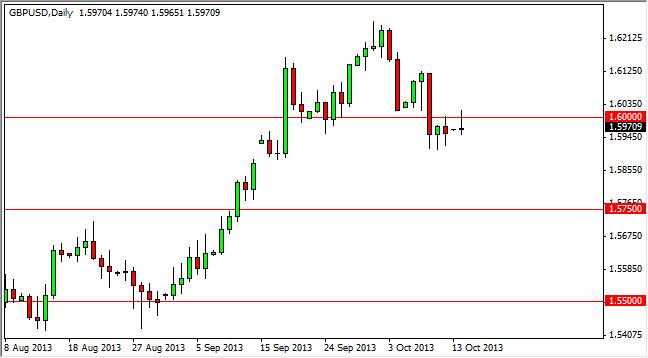

The GBP/USD pair tried to rally during the session on Monday, but as you can see found far too much resistance at the 1.60 level in order to stay above it. The resulting candle is a shooting star, and that is a negative turn of events obviously. However, I also recognize that there is a gap just below, at roughly the 1.59 handle. This of course will provide support at the same time.

That being said, I still think this pair is essentially bullish, but the shooting star does in fact suggest that we are going to struggle to go higher in the meantime. However, I believe that if we get above the top of the shooting star that is in fact a nice buy signal, and has us going back up to the 1.62 handle. Because of this, I feel that this market is essentially a "buy only" market, but we need to see that shooting star broken to the upside first in order to get bullish.

Are we just taking a breather?

Quite often, when you have a market that has been is bullish as this one, you find that there is a period of consolidation that the market will go through in order to take a breather and look for more buyers. That being said, I think that is essentially what we are seeing at the moment. After all, the Federal Reserve is nowhere near tapering off of quantitative easing, and although the British pound will have its own issues, it's not the US dollar and that's probably all that matters at the moment.

I believe that this market will eventually go looking for the 1.62 handle, but it's probably going to take some type of headline to push the market higher. As far as selling is concerned, I see no real chance of doing so, especially looking at the 1.59 handle area as a support area, and then below there the 1.5750 level as well. Because of this, I am either waiting for break of the top of the Monday shooting star, or a pullback and some type of supportive candle.