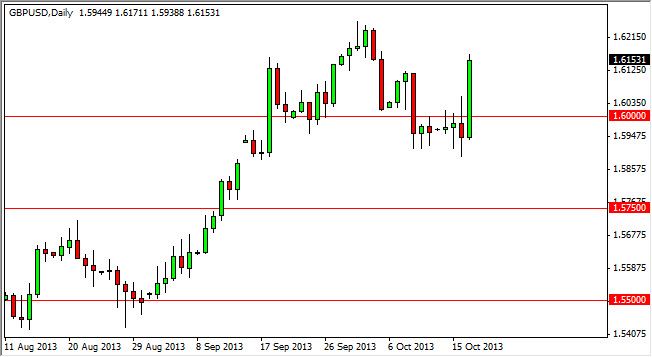

The GBP/USD pair skyrocketed during the session on Thursday, breaking well above the highs from the Wednesday range, which I had previously suggested would be a nice buying opportunity. In fact, the fact that the market broke above the 1.60 handle so easily suggests to me that we are going to see continued bullishness, and it makes sense as the FMOC member Mr. Evans suggested on Thursday that the Federal Reserve would be having to look at several months’ worth of data in order to decide whether or not to taper off of quantitative easing because of that I believe that this market will eventually hit the 1.65 handle.

Don't get me wrong, I don't think that's something that's going to happen right away, but certainly written on this market pulls back there should be buyers out there willing to step in and supported. With that being the case, I see absolutely no reason to think why this market will go to the 1.65 handle, because after all it is the next large round psychologically significant number that the market could hit.

US dollar in trouble

This pair right now is going to be more about the US dollar being in trouble than anything else. In fact, you can trade Forex based almost solely on what the US dollar is going to do. That being the case, the fact that the British economy isn't doing as poorly as it once was certainly doesn't hurt the case for a higher cable pair either.

Now that we've broken above the 1.60 handle without too many issues, I believe that the area will be the "floor" in this market going forward. If that's the case, expect pullbacks to be nice buying opportunities and the area to be extraordinarily supportive between here and there. In fact, we may not get any pullbacks. Because of that I am also willing to buy right here because I believe this is a longer-term change in this pair. Maybe not for years, but certainly for weeks we will see the British pound do better than the US dollar.