Last Wednesday’s analysis ended with the following straightforward predictions:

1. Outlook is bearish but needs confirmation

2. Needed close on Wednesday below 1.3537, and to close near low in the bottom quarter of its range and break that low Thursday

3. Short-term support likely at 1.3461

4. Resistance overhead from 1.3600 to 1.3645

Last Wednesday, the price did actually close lower than the previous Friday’s low. However, the daily candle did not close within the lowest quartile of its range, now was this low broken the next day. Therefore we did not get real confirmation for any bearish move. None of the other levels mentioned have been tested yet.

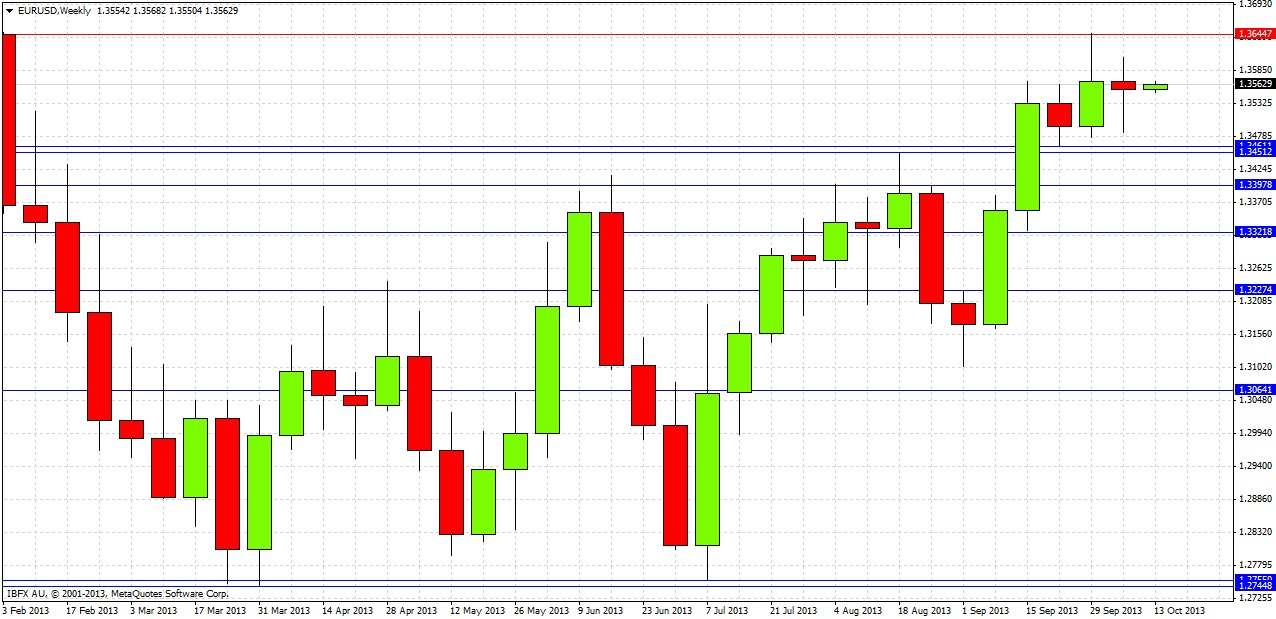

Turning to the future, let's start by taking a look at the weekly chart below

Last week was a near-doji inside bar. This does not tell us very much except that price has no clear direction and the action is quiet. Although the last five weeks all made higher lows, this doji may hint that the upwards trend is running out of steam. It looks like resistance has become support at the zone between 1.3460 and 1.3450. There is a long-term swing high above at 1.3710. This pair has not reached a higher price since November 2011.

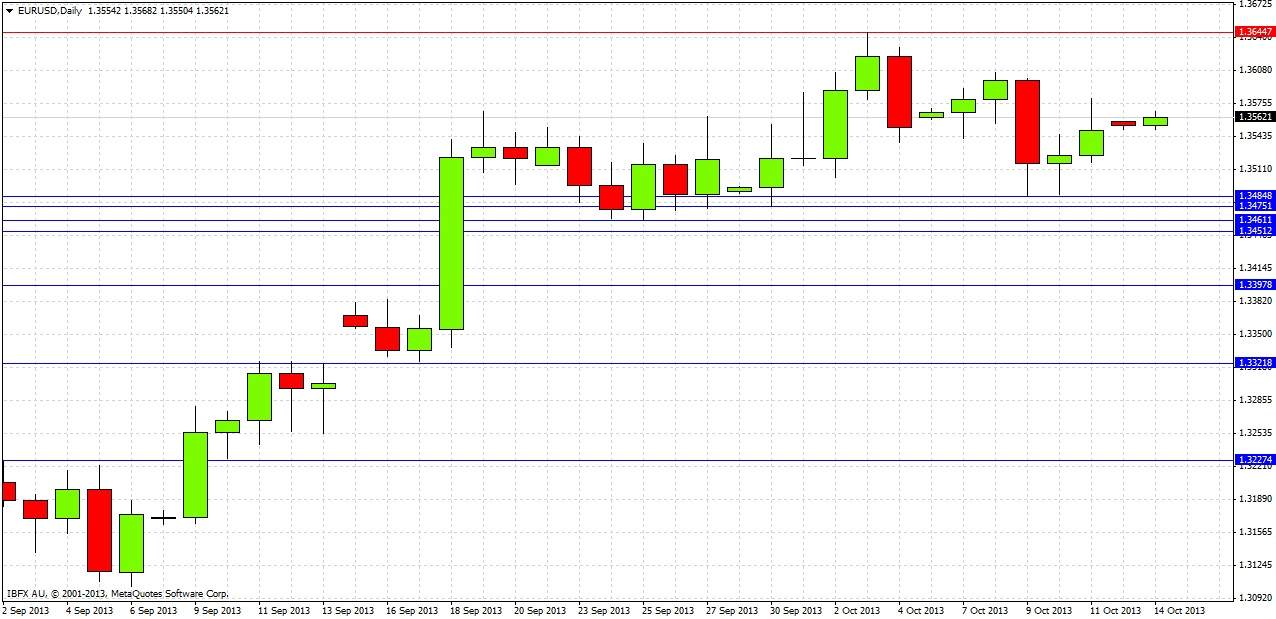

Let's drop down to the daily chart now for greater detail:

We can see that the second of last week’s strong bearish reversals, as previously mentioned, did not close in its lowest quartile. Significantly, its low was not broken the next day, which formed an inside candle. That inside candle last Thursday was itself broken to the upside the next day. This suggests that the bearish push down stalled and now may not happen at all.

Overall, the picture is confused and hard to predict. The area between 1.3485 and 1.3452 has for almost one month held as support, however it is hard to see any upwards momentum. The most impulsive recent action was downwards from 1.3645.

It is hard to make any predictions beyond that there might be scope for scalping long trades off 1.3485 under relaxed conditions, and an opportunity to go short from any sudden fall from a price level at 1.3600 or above. Overall, this pair does not look very promising to trade, and is hard to predict right now. We need more action to happen to get a clearer picture of the most likely next move.