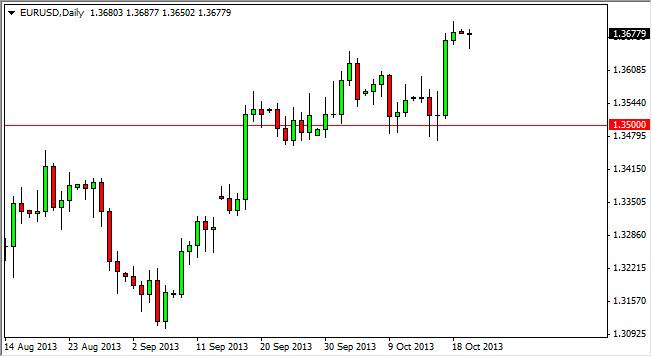

The EUR/USD pair did very little during the session on Monday, but this makes sense of course considering that the nonfarm payroll numbers are coming out today. The markets have been concerned as to whether or not the Federal Reserve can taper off of quantitative easing, which should dictate the value the US dollar in general. FMOC member Evans has already suggested that the Federal Reserve is going to have to look for data over the next couple of months and make a decision. Because of this, I believe that the US dollar will continue to be beat up, and as a result this pair will more than likely go higher.

However, the consensus is that the employment numbers will drive the decision more than anything else. That is what makes today session so important. That being the case, we have a hammer for the session on Monday, which means that there is a little bit of support. The shooting star on Friday of course suggests the exact opposite and therefore I think that we are more than likely in a holding pattern of sorts until we get that number.

8:30 AM Eastern Standard Time

The numbers come out at 8:30 AM Eastern Standard Time, which is the same thing as saying 8:30 AM New York time, for those of you around the world. Because of this, I do not expect to see much in the way of this market until we get that number, and quite frankly the most important thing will be how the market closes. If we can break above the shooting star from the Friday session, I believe that this market will head to the 1.40 handle, and possibly even higher. Because of that potential, I am willing to wait until the close to make a trade, simply because in nonfarm payroll number often causes extraordinarily volatile sessions, and can cause a lot of damage to your account if you are not careful.

If we break the bottom of the hammer, I believe that the market will find a floor at the 1.35 handle, of course should be very supportive as this market has shown time and time again.