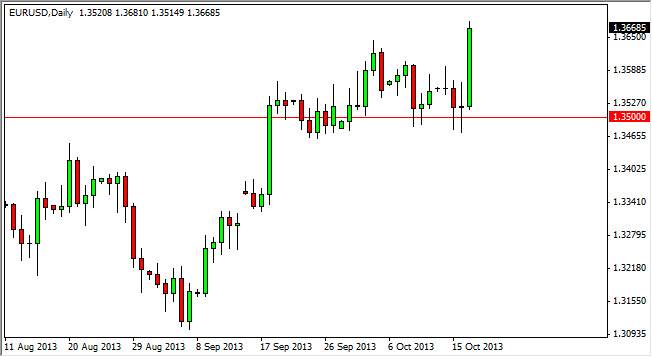

The EUR/USD pair shot straight through the ceiling during the session on Thursday as the US dollar was pummeled in general. In fact, the fact that the FMOC member Mr. Evans suggested that the Federal Reserve will be looking at several months’ worth of data in order to decide on tapering off of quantitative easing really put a lot of downward into whether or not the Federal Reserve could do anything. If the Federal Reserve simply cannot taper off of quantitative easing. One has to wonder whether or not there is any reasonable expectation of support for the US dollar going forward.

Remember, the Euro is the "anti-dollar", and as a result it's the first currency to normally be benefited by something going wrong in the US dollar. The fact that we have cleared the 1.3650 level is a buy signal in and of itself, and I believe that every time this market pulls back there will be buyers willing to step in. I frankly, I would not be surprised to see the 1.40 handle hit over the course of the next couple of months, as the market continues to grind higher and higher.

European Union exits recession, Federal Reserve sits there with its hands tied.

With the European Union exiting recession, it makes sense that the Euro would be in more demand than it once was. The recent surge higher of course have seen sideways action following, but that's typical technical analysis. Now that it's becoming more and more clear that the Federal Reserve probably doesn't have much of a chance to change its policy anytime soon, it makes sense of the US dollar will be punished for this. I believe that going forward buying the Euro in selling the Dollar will be the correct trade, and be a nice profitable one. I look at short-term chart for entries, perhaps hourly charts that show signs of support. Quite frankly, where the pair sits at the end of the day is perfectly acceptable for a buying opportunity in and of itself. I believe that the 1.35 level is now the "floor" in this market.