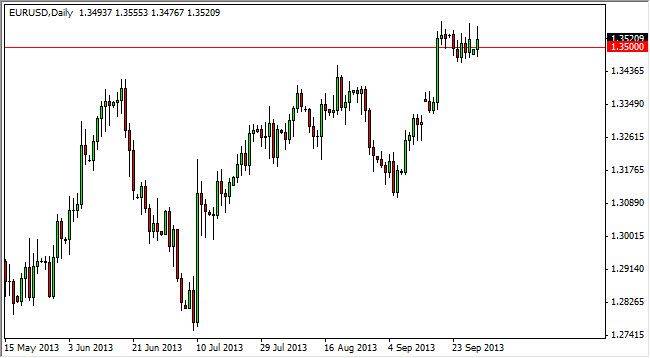

The EUR/USD pair rallied during the session on Monday, but gave back about half of the gains yet again. The 1.35 level continues to be a magnet for price, and an area that the market simply can't get past. With that being the case, I feel that this market is essentially to sit still until Friday, as Friday is the nonfarm payroll report. Because of this, I am very neutral this market but do recognize the fact that we managed to break above the recent highs over the last couple of weeks, this market could really take off at that point in time.

The shape of the candles of the last couple of weeks do suggest that perhaps the resistance above is significant. With that being the case, it's almost impossible to think about going long into we get a significant break. That break will almost be undoubtedly in the form of a poor job numbers coming out of America as it would suggest that the Federal Reserve is farther away from tapering than people are imagining.

It's all about expectations

Quite frankly, I believe that this market will be determined by the expectations coming out of the central banks. Obviously, the Federal Reserve is the bigger of the two central banks, and therefore the more important of the two. Because of this I feel that this market will try to figure something out from the jobs number, but in reality will more than likely continue to be stymied by the indecision of central bankers who obviously don't necessarily have a clue themselves.

Ultimately, I do think that a pullback is more than likely going to be a buying opportunity, and was of course the jobs number out United States is fairly strong. The 1.34 level has been resistive in the past, and therefore I feel that I would more than likely be supportive as well. That being said, if we do get a pullback, I would not hesitate to buy a supportive candle somewhere in that general vicinity as I fully expected to be noticed by traders around the world.