Last Thursday's analysis ended with the following straightforward recommendations:

1. Go long in the area 1.3460 – 1.3450

2. Go short off any bearish reversal between 1.3600 and 1.3710

3. Any daily close above 1.3710 will be a very bullish sign and mean the pair should continue up to 1.4000

4. Any daily close below 1.3450 will indicate a new down trend has begun

The price has not reached 1.3460 since last Thursday, and we have not had a daily close above 1.3710, so the only applicable recommendation was the short off a reversal between 1.3600 and 1.3710. The price did rise above 1.3600 later that same day, reaching a high of 1.3645 before falling about 120 pips as at the time of writing. There were a couple of good reversals on the shorter term charts that would have yielded good risk to reward ratios in short pips so far, so this was a useful recommendation.

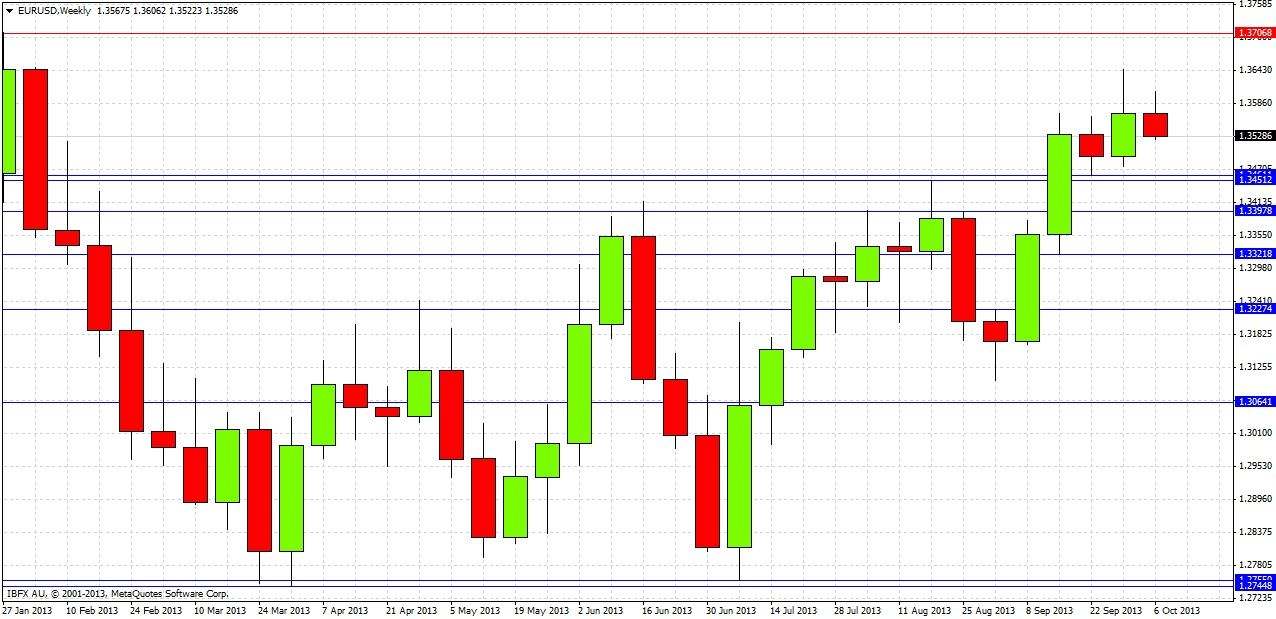

Turning to the future, let's start by taking a look at the weekly chart below

Last week was a bullish reversal, but it was weak as it closed just about in the bottom half of its range. So far the action this week has been bearish and we are at the weekly low. The low from two weeks ago is very close to a previous week’s high from August, so it looks like resistance has become support at the zone between 1.3460 and 1.3450. There is a long-term swing high above at 1.3710. This pair has not reached a higher price since November 2011.

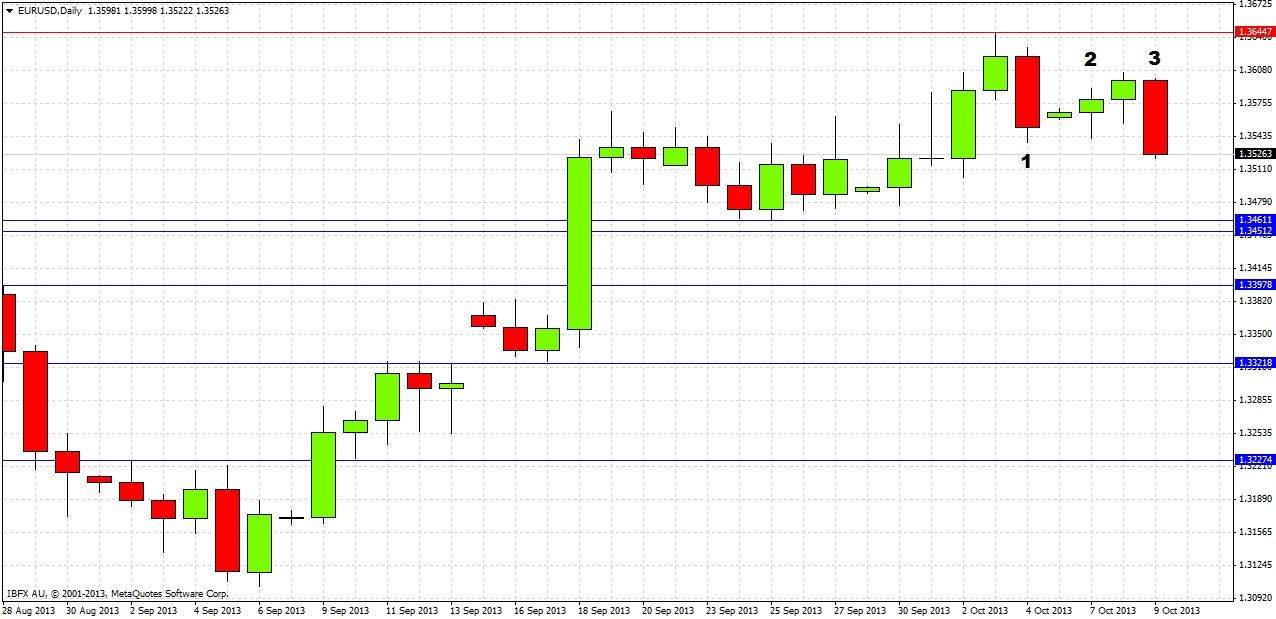

Let's drop down to the daily chart now for greater detail:

The daily chart shows that last Friday had a pretty strong bearish reversal (marked at 1). Monday and Tuesday (marked at 2) then showed a classic pull back, with small bullish inside bars (inside Friday’s mother bar) closing close to their highs. The action so far today (marked at 3) has produced another bearish reversal candle.

The outlook right now is certainly bearish, but how today closes will be very crucial to the analysis of this pair going forward. If today closes below Friday’s low of 1.3537, and also closes in the bottom quarter of its range, and breaks today’s low tomorrow, this will be a near-perfect bearish 123 set-up that will be likely to produce a significant further move down.

We can still expect at least some short-term support at 1.3461.

If today does not close as bearish as expected, then a semi-bearish consolidation pattern is likely to follow. However any close today below 1.3537 will be a bearish sign that a new down trend has begun.

We have resistance overhead from 1.3600 to 1.3645 and other support levels below 1.3461.