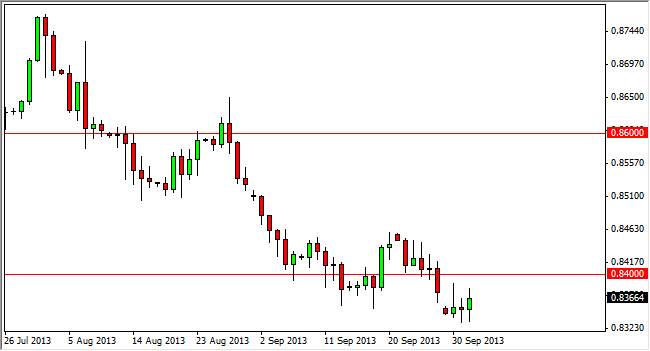

The EUR/GBP market rose during the session on Wednesday after initially falling, showing that this market is still tight and stuck in consolidation. The consolidation area is just below the 0.84 level, an area that was one significant support. Because of that, I feel that this market will struggle to get back above the 0.84 level, and quite frankly most of the people around the Forex world are not concerned about either one of these currencies against the other one. In fact, it's all about the Euro and the Pound against the Dollar.

Going forward, I fully expect this market to continue to be tight and messy, but I do think there's a definite downward bias to it. Because of this, I feel that if we break the bottom of the trading range for the Wednesday session, it's probably good enough to start selling again. After all, the next natural place for this market to head will be the 0.80 level, which of course is a large round psychologically significant number.

At best, this is a tertiary indicator.

I think the best way to use this pair is to decide which one of the currencies to trade against the US dollar. On top of that, it tells you which direction to trade it. For example, right now looks like the Euro is weaker than the Pound. In that particular circumstance, it makes more sense to sell the Euro against the dollar, or buying the Pound against it, depending on how the Dollar is doing during the session. After all, both of these currencies tend to move in the same direction against the Dollar, but in the end one of them has to be stronger than the other one. That is essentially what this market is all about, relative strength.

The two economies are highly intertwined, so it makes sense that this is relatively choppy trading action. There really isn't anything going on and he the one that drives the value in one direction or the other at the moment, so expect quiet yet choppy conditions going forward.