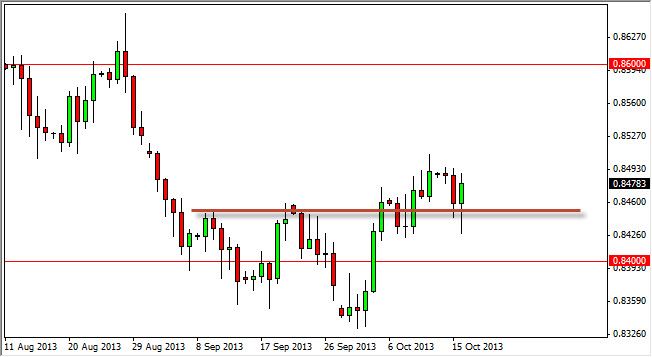

The EUR/GBP pair fell during the bulk of the session on Wednesday, but as you can see the market bounced hard enough to form a pretty impressive looking hammer. This hammer is based around the 0.8450 level, which is the top of the recent consolidation area that we have just broken out of. Because of this, it makes sense that this market would go higher now that we have retest that previous resistance for support, and now that I have seen this hammer, I am willing to start buying this pair above the 0.85 handle, as it would show a continuation of the momentum higher.

That being said, I expect the 0.86 level to be about as far as this market goes in the short term. That isn't exactly an endorsement for a massive trade, but it is looking better and better as time goes on. That being the case, I don't necessarily think that a full sized position is in order here, but we could get a quick pop to the upside that is profitable.

Even breaking the bottom of the hammer may not mean much

Breaking the bottom of the hammer normally is a very negative sign, but in this particular instance I see a lot of noise between here and the 0.8350 handle, which of course makes me think that there are buyers below waiting to step into the marketplace. Granted, I see that the market has been in a crater downtrend over the longer term, but in the end I think this market is starting to firm up a little bit down here. On top of that, on the longer-term charts the 0.84 level is looking more and more interesting, so therefore I'm not necessarily confident that we are in a breakdown too much farther now.

Also, as soon as the Federal Reserve shows that he cannot taper off of quantitative easing, I fully expect the Euro to get bid up against the US dollar, and that of course will have a knock on effect in this market. Going forward, I think we could break above the 0.86 handle, but it's going to take quite a bit of work.