The AUD/USD pair shot higher during the session on Tuesday, as the nonfarm payroll numbers came out rather disappointing. The Federal Reserve is already stating that it is essentially watching the employment numbers as to whether or not you can taper off of quantitative easing or not, and since we have come out lighter than expected yet again, it looks like we will not see tapering during the year 2013. It is now obvious that it will be 2014 before we see any tapering off of quantitative easing, so this of course is dollar negative.

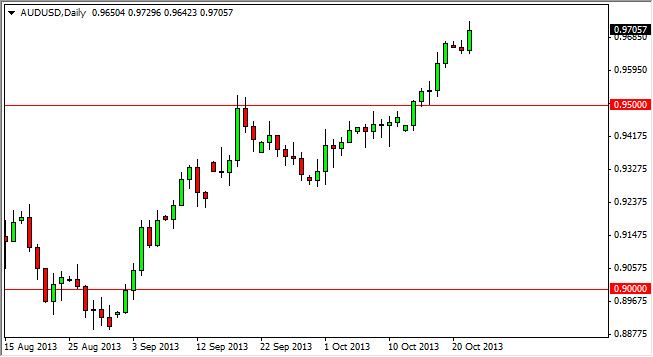

Remember, the Australians export a lot of gold, so this market tends to follow the gold markets overall. Gold of course got a bid as the US dollar got stung during the session, and because of this it makes sense of this correlation held up rather nicely. The Australian dollar went above the 0.97 level for the first time in ages, and it does appear that we are getting ready to extend the already long running uptrend.

Employment numbers, gold, and any type of quantitative easing programs out of Asia.

Employment numbers of the United States will continue to be a major driver of the US dollar. In turn, this market will move in reaction, as the gold markets will also. Adding to that will be whether or not the Asians continue to build their infrastructure up, which is one of the favored moves in Asia when economy start to stagnate a bit. If that happens, expect a lot of natural resources needed to be found in Australia as it is the "supermarket" to Asia for such commodities as gold, copper, and iron. All of these of course are needed in construction projects, which is why they're so highly correlated.

Looking at the chart, I see that there is a significant amount of support just waiting to happen at the 0.95 level, and as a result I have that as the "floor" in this market. I do not see the market going below there, and would jump all over a supportive candle in that general region if I got it. On the other hand, I am more than willing to buy a break of the highs for the session on Tuesday as well, as it just simply shows an extension of the upward momentum.