Last week's analysis concluded by summarizing the situation like this:

"….trade reversals off the triangle trend lines, or a daily close breakout beyond the trend lines in either direction. Aggressive traders can enter immediately, more conservative traders could wait for a pull-back and retest of the broken trend line."

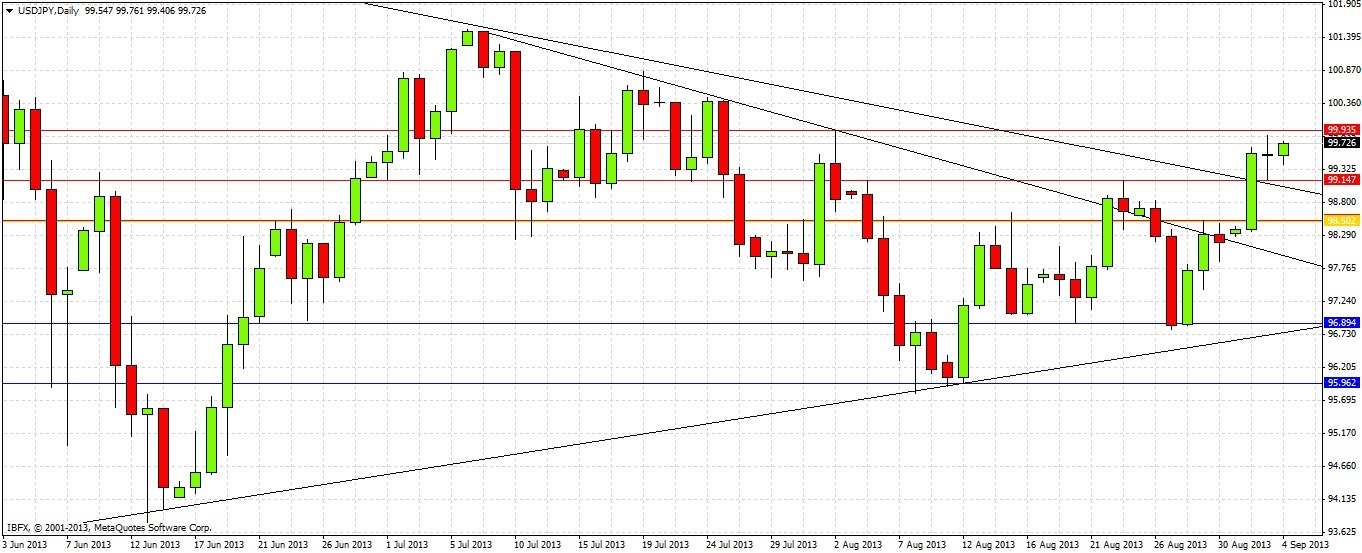

The daily chart below shows that we had a valid bullish breakout with a close well above the trend lines on Monday, and that the price has been holding up well and rising since then:

Looking to the future, its a new month now, so let's take a look at the monthly chart:

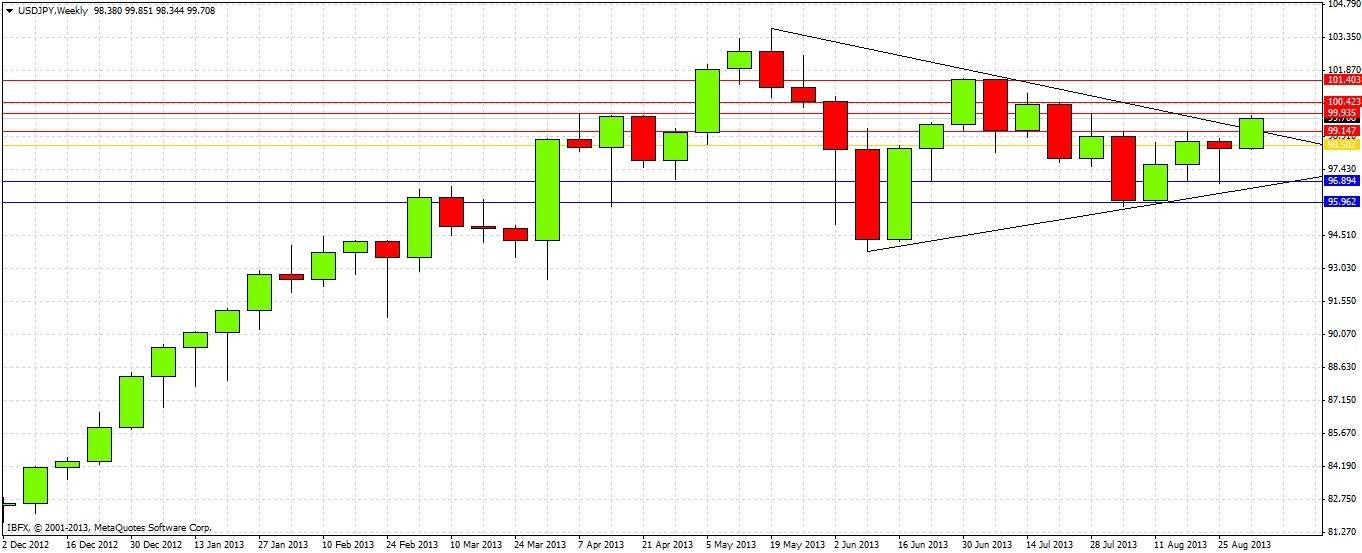

This chart doesn't really tell us much, except that the action last month was very indecisive and contained within the triangle. Let's try the weekly chart:

This is more interesting, as it reveals that we have two potential resistance levels above us at 100.42 and 101.40, caused by the highs of the two bearish reversal weeks. It is unclear if these will be significant resistance or not, they should be noted anyway.

Let's take a closer look at the daily chart that we already saw:

Monday was a bullish engulfing candle that closed very near its high well above the trend line, so it looks like a strong bullish breakout. Momentum and bias are bullish, so it is a question of looking where to take profits and where pullbacks might find support in any pauses in the uptrend.

Firstly, looking at support level,s we have 99.15 immediately below. This acted as support yesterday (daily low), after having acted as resistance twice during August, both times as weekly highs. This is resistance turned into support and should now become strong support, especially if it is not reached today. Below that, we have 98.50 which is weaker but has often acted as a price pivot in recent days and weeks. Well below that, we have strong support at around 96.90.

Secondly, points of potential resistance overhead start with the key psychological number of 100.00 where the should be some kind of bounce due to profit taking. Beyond that there is a zone of resistance from around 100.40 to 100.80. Should the USD blast through these levels, it will probably keep going to 103.50. There is also another zone of resistance further on, at around 101.40 to 101.50, but this is likely to be weaker resistance.