Last Wednesday’s analysis concluded by summarizing the situation like this:

"Without any doubt, the overall bias must remain strongly bullish. The major question is whether the resistance from 100.40 to 100.80 is going to be respected in the near future or not. If this area is quickly and strongly breached to the upside, price should power up to 103.50. We can expect 100.85 to be very strong resistance, however. If this area does hold, we can expect a period of consolidation. There is no obvious support level below above 98.55, so traders desperate for a long entry when we are at the lows of any range that develops would be well advised to look for something like a round number such as 99.00, hopefully in conjunction with a pivot or some other supporting indicator. A return to 98.55 would be a good buying opportunity especially if combined with a fast retest of the upper trend line a bit lower.

A consolidation under 100.40 is quite probable, if this builds up plenty of steam it could open up a great bullish breakout play."

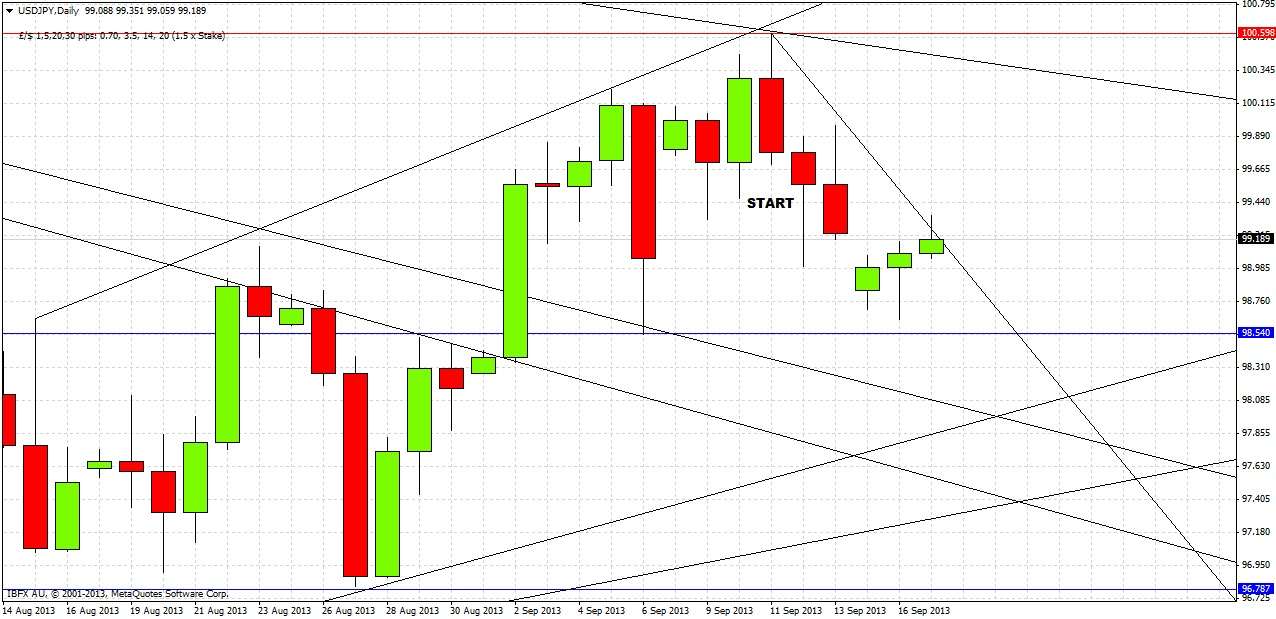

This prediction worked well as a guide. Price rose bullishly into the resistance zone above 100.40 to 100.80, which was respected, with the price reaching a high of 100.60 last Wednesday. The observation that there was “no obvious support level” above 98.55 turned out to be correct as the price fell down to that level, reaching 98.45 in early Australian trading Monday morning (not shown in the chart below which begins with the Tokyo open), before rising again. We can see how it played out in the daily chart below:

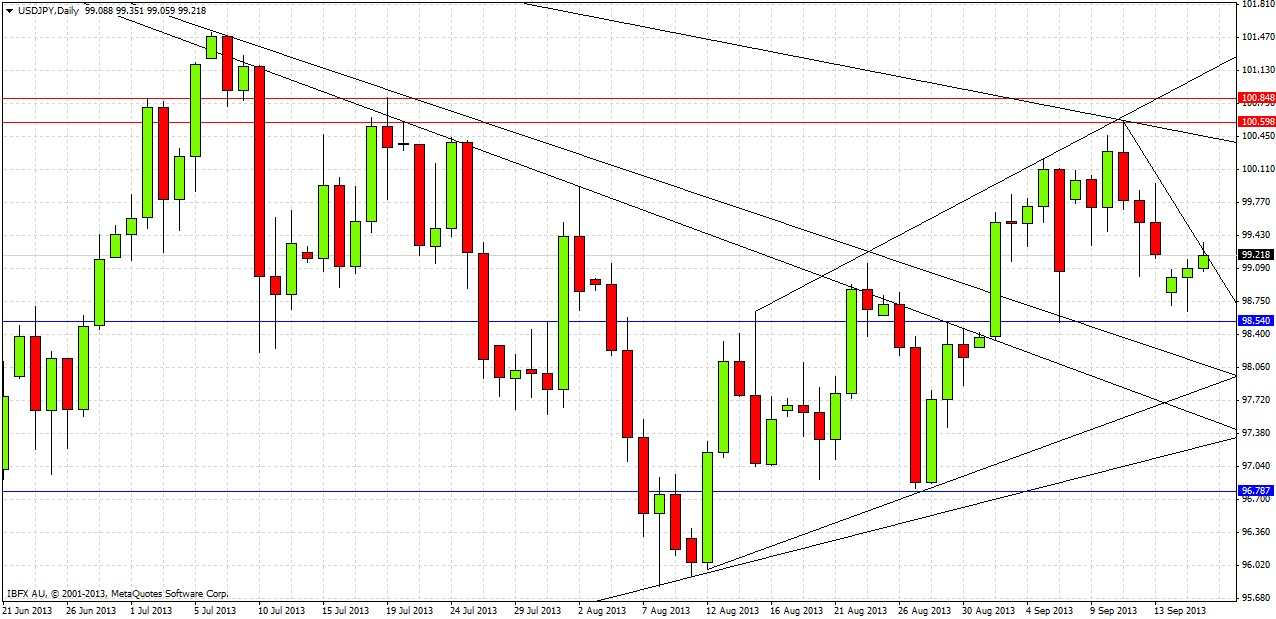

Looking to the future, let's start by examining the weekly chart

There is nothing especially interesting about last week’s candle. What is interesting is that the bullish breakout of the summer’s triangle continues, albeit weakly, with a bullish channel emerging from the triangle. Above us we can also draw a new upper triangle trend line. The question is whether the triangle or the channel will dominate. There is also a bearish trend line that looks stronger on the daily chart, which the price is struggling to break through right now.

There is support below at 98.54 and further down at 96.79. There is a zone of resistance above from 100.40 to 100.85.

Let's drill down to the daily chart again, for greater detail:

It will be a bullish sign if the bearish trend line is broken through soon, before 98.54 is reached again. If this happens, the price should proceed upwards to 100.00 and possibly beyond that. If the trend line holds, it is still likely that 98.54 would act as some kind of support again, but if this level is tested today it might be weaker – the longer before it is tested, the stronger support it should be. If there is a breakdown, 96.79 should be excellent support.

The overall bias should remain bullish, but we will need some momentum to break through this zone of 100.40-85 which is behaving as a great zone to short. There does not seem to be any fundamental difference between the picture today and one week ago. This pair is one of the major focuses of attention in the Forex market and is continuing to offer good trading opportunities.

It is recommended to maintain a bullish bias over the coming week as long as 98.54 and the bullish channel hold. If the price breaks decisively through 100.85, it should proceed to 103.50, but it seems unlikely this will happen any time soon. It is quite likely there will be good opportunities to short reversals between 100.40 and 100.85 in the meantime.

We can monitor bullish progress by monitoring how the bullish channel holds as against the upper triangle trend line.