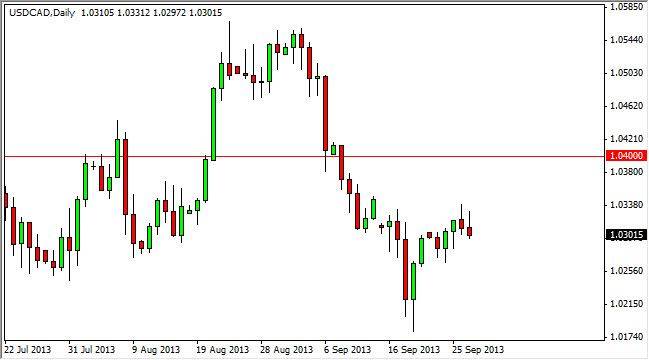

The USD/CAD pair tried to rally during the session on Friday, but as you can see gave back most of the gains and ended up forming a negative shooting star. The shooting star of course is a negative sign, but we also have hammers from earlier in the week which suggests to me that this market is going to be very tight going forward. I do see the case for a move back down to the 1.02 handle, and the short-term trader may be able to take that move, but quite frankly I am not comfortable doing that.

That being said, this market has a long history of going sideways for considerable amount of time and then suddenly breaking in one direction or the other. It makes complete sense if you think about it though, the two economies are so intertwined that they are completely reliant upon each other, or it's probably more accurate to suggest that the Canadian economy is reliant on the American one.

Watch the oil markets as usual

Oil markets of course drive the value of the Loonie more than anything else, and as a result you should be paying attention to them. However, having said that we feel that the oil markets are a bit range bound at the moment as well. We could see a rise in oil prices, which should push this pair down, but we don't see anything that's going to break the market out in one direction or the other for any long-term significant moves.

The 1.04 level is resistive, so even if we break the top of the shooting stars which of course would be very bullish sign, we would be a bit hesitant to start buying for anything longer than a short-term trade. A daily close above the 1.04 handle however would change the complexity of this market completely, pushing the value the US dollar much higher. I do not think that this market is going to run away in either direction for any length of time soon, so quite frankly playing the tight ranges will be the realm of the short-term scalpers.