By: DailyForex.com

The NZD/USD pair went back and forth during the session on Wednesday, which I found very interesting considering the fact that we had fallen with some force during the Tuesday session. That being the case, I feel that this market is trying to show us that it still has a fairly positive bias at the moment, and as a result I'm actually looking for some type of buying opportunity in this general vicinity.

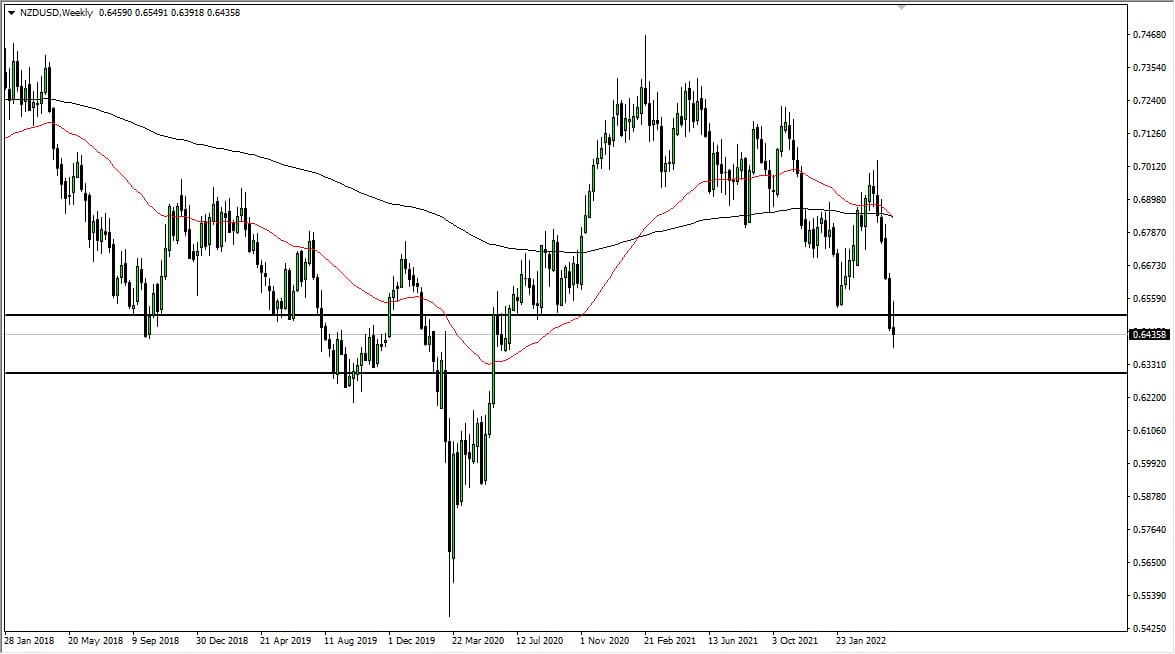

I think the 0.82 level is going offer a significant amount of support, so any pullback at this point time is simply going to be a buying opportunity. On top of that, I see support all the way down to the 0.80 handle first, and then as low 0.77, although I find it very difficult to imagine that this market is going to go that low.

Risk appetite will continue to push the New Zealand dollar around

The New Zealand dollar is a favorite of traders looking for some way to express their tolerance for risk, and as a result I think we will continue to see this market gyrate wildly simply because the markets are so erratic at the moment. At one point in time, we have quite a bit of risk appetite out there, but then it only takes a quick headline to throw everybody back into another direction. With that being the case, you can expect a lot of volatility in the New Zealand dollar, and of course the commodity markets will continue to play a massive part on where the market goes.

All things being equal though, I do believe that this pair does continue to the 0.85 handle, which is the next major big figure. It might be a bumpy ride, but I don't think that the sentence selloff that we have seen over the last couple of days means much, especially when you look at it in the big picture as it was just the simple and short pullback. That being the case, I fully expect to see the US dollar on the back foot for a while based upon the Federal Reserve and its lack of tapering off of quantitative easing, which means that the New Zealand dollar should do fairly well over the longer term.