The XAU/USD pair printed another bearish candle yesterday on the back of the solid U.S. economic figures. Data released by the Labor Department showed that the number of first-time applicants for unemployment insurance payments declined by 9K to 323K and the Institute for Supply Management reported that its services index increased to 58.6 from 56.0 a month earlier.

The ADP Research Institute's non-farm payrolls data came in as anticipated and showed a gain of 176K for August. Since prospects for an imminent attack against Syria abated temporarily, the American dollar is heavily influenced by optimistic data.

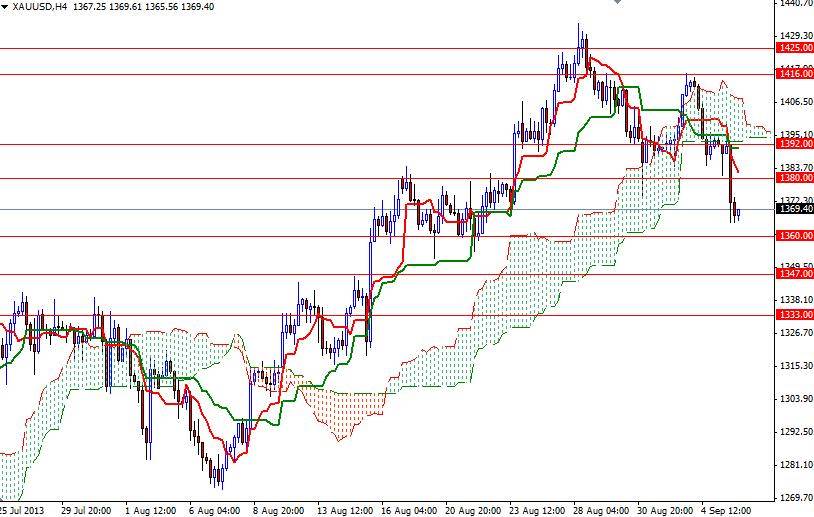

As a result, gold closed the day at 1367.28 and this is the lowest settlement since August 23. On the 4-hour time frame, the XAU/USD pair is trading below the Ichimoku cloud and we have a bearish Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-day moving average, green line) cross. Because of that I think 1353-1347 support zone which also converges with the bottom of the ascending channel will be very important for the future direction of this pair. If this floor is breached, I believe that the downward pressure will increase and we will be heading back to 1333 - 1319 area.

Intra-day traders should pay attention to the 1360 support level. If the bulls gain some strength and defend this level, we may see a bullish attempt towards 1405. On its way up, expect to resistance at 1380 and 1392. A daily close above the 1405 level means it is likely that we will see the bulls testing the barriers at 1416 and 1425 once again. The main event of the day clearly will be the release of the government’s employment figures.