Last Monday's analysis ended like this:

"From the messages that the charts are giving us, it makes sense to open this week with only a weak long bias. The worrying thing is that the action in this pair has become quite thin, the moves are not strong and seem to lack real conviction. That can change quickly, but as things stand it is hard to feel the kind of momentum necessary to break through the key psychological/resistance level at 1.5750. Until 1.5730 is reached, barring any strong bearishness, it will be best to maintain a bullish bias and look for longs.

As direction is not very strong, it would be advisable to look for short opportunities from 1.5730 to 1.5750, and long opportunities at 1.5423."

This forecast worked out well: it was accurate. The price rose steadily after publication, reaching a high of 1.5731 later that same day towards the end of the London session, from which it fell to a low of 1.5685. Since then it has risen, but has not yet surpassed 1.5750. Unfortunately, there has not been a lot of profit in being right on this pair, as action has remained thin and weak.

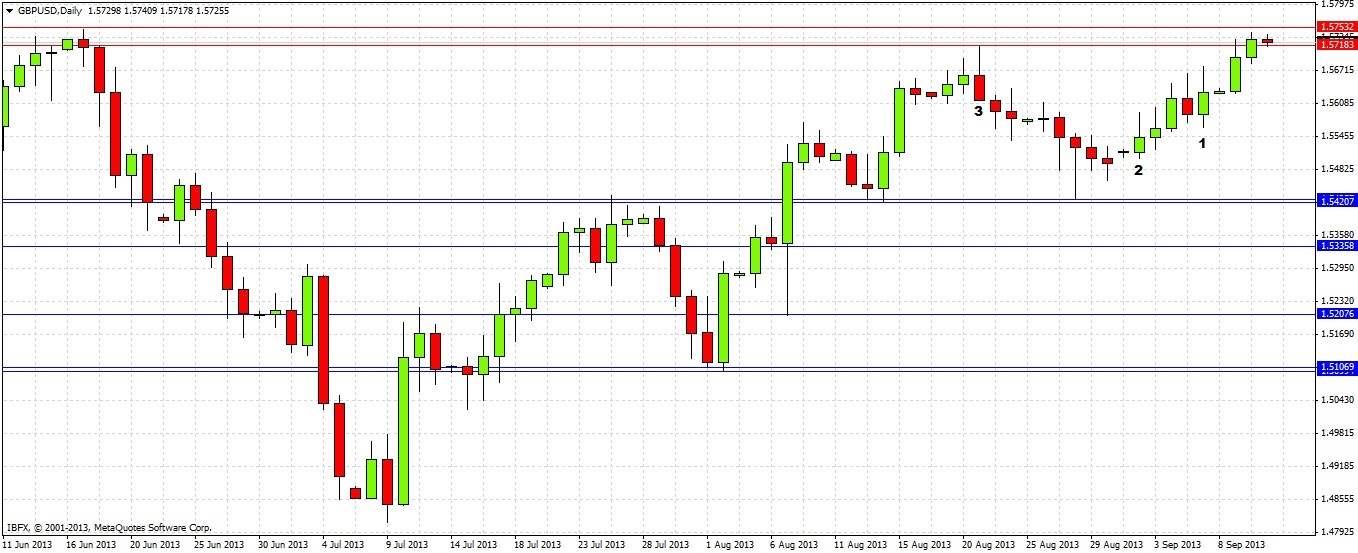

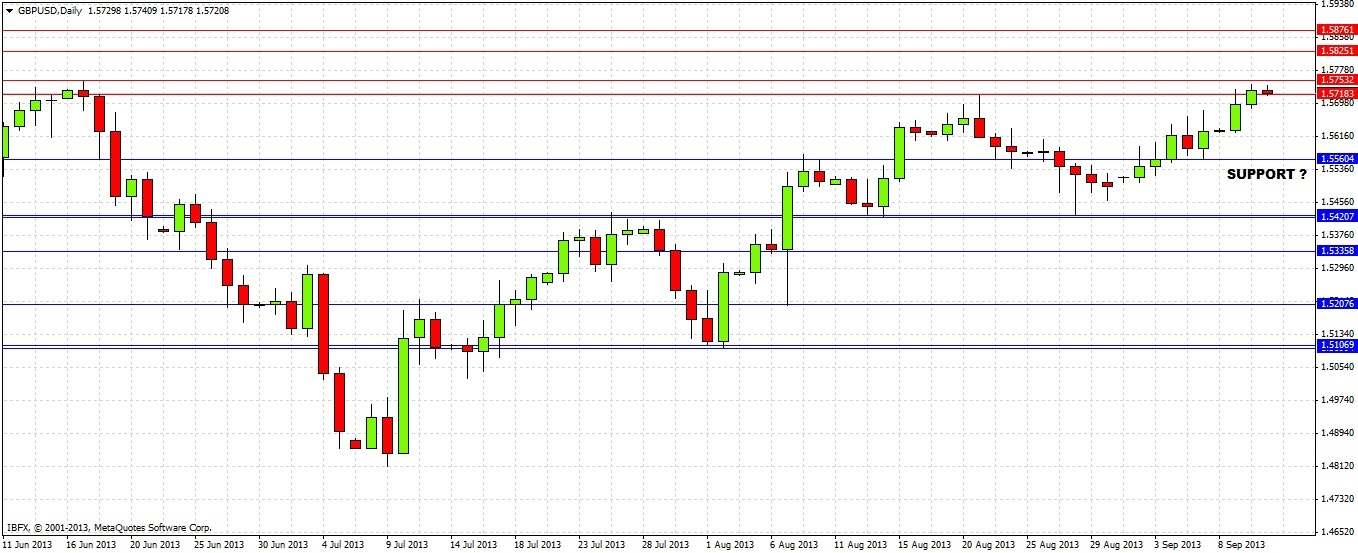

Turning to the future, let's begin by taking a look at the daily chart

The action has been very bullish this week, following Friday's bullish reversal bar at 1. We have exceeded the previous swing high at 1.5718 which may now be acting as support.

The important question is whether 1.5750 will hold as resistance, and whether 1.5718 will hold as support.

If we break down through 1.5718, we should go down, to what level is unclear. Possibly new support at 1.5560.

If we break up through 1.5750, we should have a clear run until resistance at 1.5825. There is a resistance level beyond that at 1.5875 that should prove to be very strong.

Much further down, there is still very strong support at 1.5425

Worthwhile recommendations are:

1. Maintain a bullish bias unless 1.5718 is decisively broken to the down side, or until there is a reversal off 1.5825, or until 1.5875.

2. Look for longs at a bullish reversal off 1.5560.

3. Look for longs at 1.5425.

4. Look for shorts off bearish reversals from 1.5750, 1.5825 or at 5875.

GBP is a strong currency now, however the action in this pair is still very thin. It remains uncomfortable to trade until the volatility increases.