Last Thursday, our analysis ended with:

"A good trading plan would be to focus upon long trades, at least until 1.3397 is reached, where short trades off obvious bearish reversals should be considered positively. Adequate areas to look for longs would be any of the recent daily lows, especially between the 1.3230 and 1.3300 levels.

Should price dramatically move beyond the areas discussed so far, there should be good support just above 1.3100 and strong resistance at 1.3500. The 1.3500 level is a key swing high, a key psychological number, and the 50% Fibonacci retracement of a multi-year down wave that bottomed out in 2012 just above 1.2000. When it was hit from below last February, the price began a 750 pip move down."

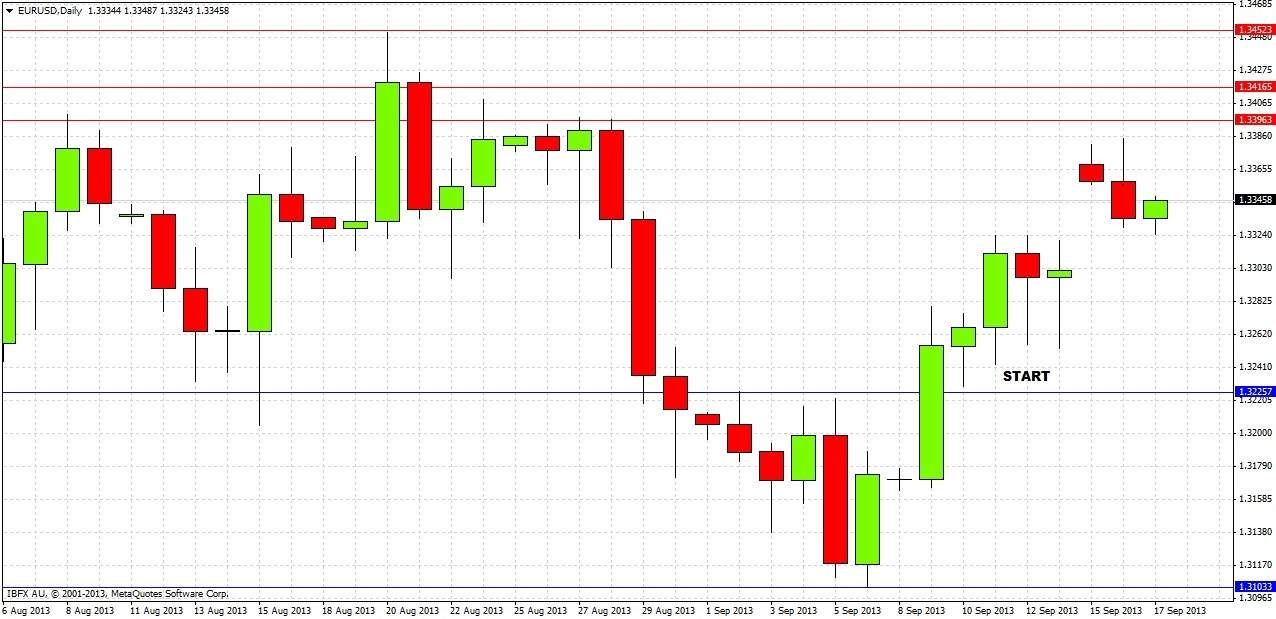

Let’s take a look at the daily chart and see how things turned out

The prediction was correct insofar as the action was bullish overall, with the price reaching a high of 1.3385 yesterday. A long trade was recommended at the retest of any daily low, and we can see that Thursday’s low of 1.3255 was hit on Friday, giving a maximum of 130 long pips with only a 2 pip draw down. Overall, it was a nicely profitable prediction. The other levels mentioned have not been hit yet.

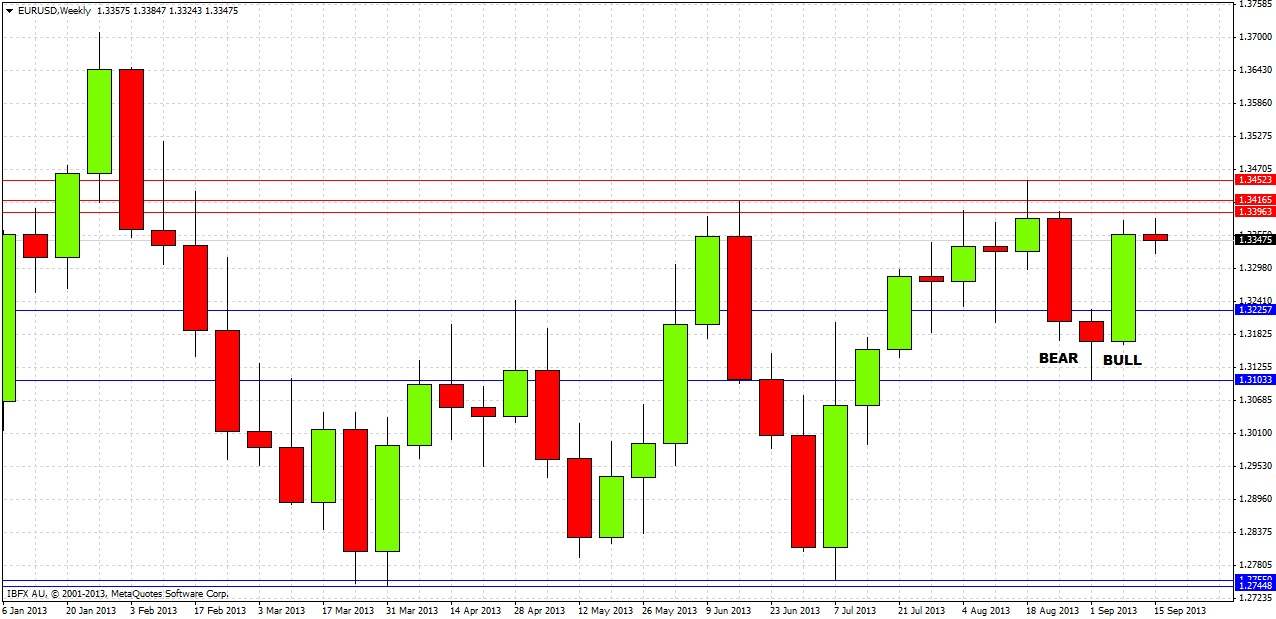

Looking to the future, let’s start by examining the weekly chart

We can see from the chart that last week was a bullish reversal, but the high of the bear reversal two weeks before that remains intact. There is a strong zone of resistance overhead from 1.3400 to 1.3450 and it would be foolish to long into this zone until price decisively breaks through to the upside. Below us there is support sat a weekly low of 1.3104.

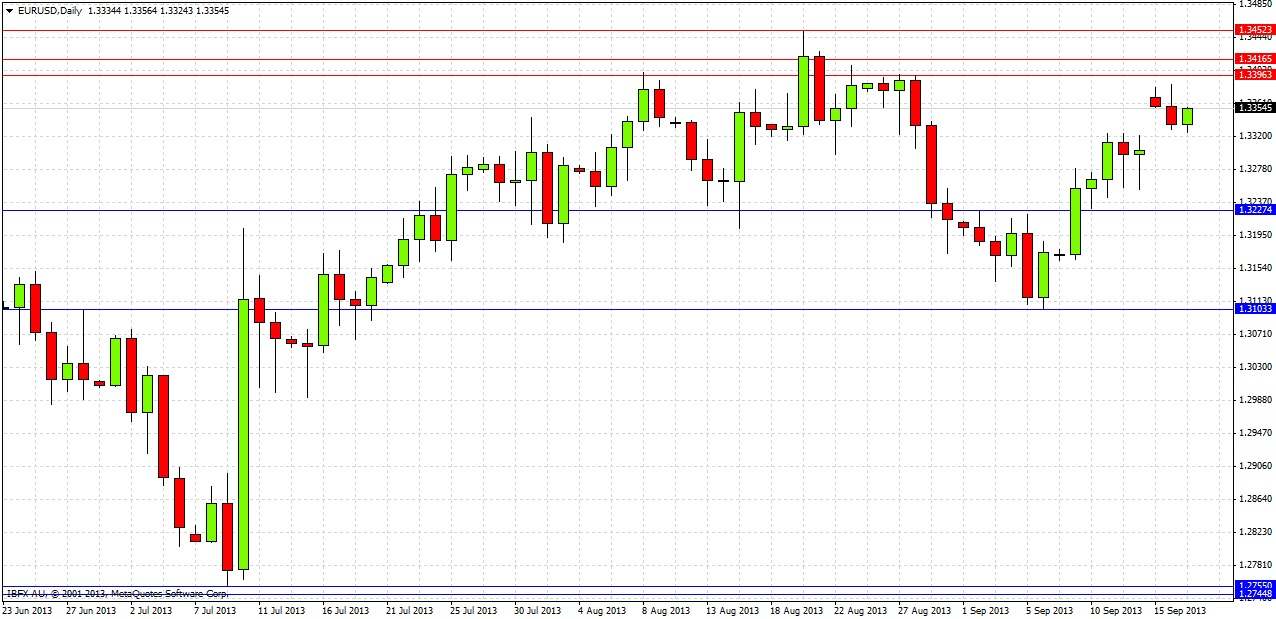

Let’s get some more detail by taking another look at the daily chart

This does not really give us much more to work with, apart from identifying a resistance turned support level at 1.3227.

Overall, things look uncertain with this pair, although bias must remain weakly bullish for the time being. If we break strongly through the resistance overhead, we could see a move up to very heavy resistance at 1.3500, but this seems unlikely. However there is major economic data in both the EUR and USD later today which could move the pair.

Due to the strength and persistence of the overhead resistance, we can recommend short trades off reversals from the 1.3400 – 1.3450 zone, and long trades off reversals from any pull back to 1.3227 and 1.3104, both of which could be used as profit targets for any short trades.