The EUR/USD pair did very little during the session on Monday as one would expect, after all it was Labor Day in both the United States and Canada. With that being the case, there was a significant portion of this day that would have very little in the way of volume. That means that to break down a significant barrier such as the 1.32 support zone would take something rather special.

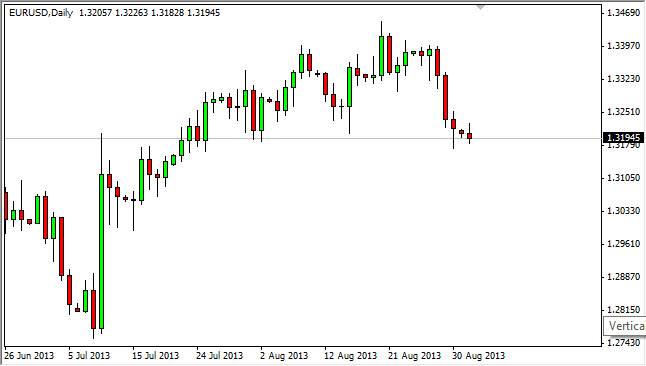

Looking at this chart, it's easy to ascertain that there is a significant amount of support in the general region, and that we have been consolidating between 1.32 and 1.34 for some time now. This makes sense, because the Federal Reserve is about to make a significant decision on whether or not it wants to taper off of quantitative easing. Because of this, I find it difficult to place any longer-term positions in this market until that announcement is made. Simply put, it would be very easy to get burned by a "head fake" in this marketplace at this time.

There are levels however

Looking at the Friday candle, you can see that a hammer printed. Because of this, I would consider shorting on a break lower. However, I also recognize the fact that it's going to be a significant fight to get much lower, but that break technically would signal a move to 1.28 or so over the longer term. However, the Federal Reserve could in fact delay tapering off of quantitative easing, which would send the markets running straight up in this pair. Because of this, you have to be very careful at this moment in time, and at the very least move stop losses to breakeven as soon as possible.

That being said, I would follow the market down as it would try to "get ahead" of the possible Federal Reserve decision to taper. That of course is dollar positive, and would be a significant reason to push his pair much lower. On the other hand, if we break the top of the hammer from Friday, that would signal to me that we are in fact going to continue to consolidate, and could move back to 1.34 between now and that decision.