By: DailyForex.com

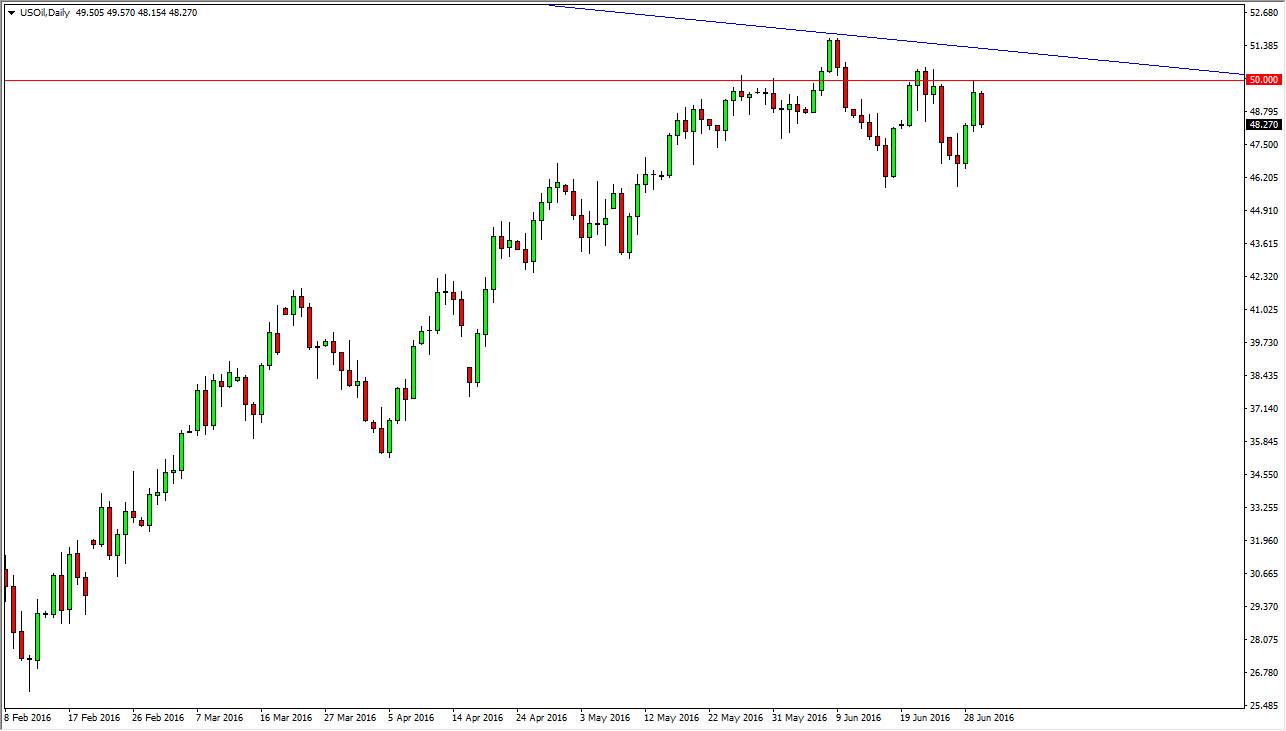

The WTI Crude Oil markets rose during the session on Thursday to continue grinding sideways. With this being nonfarm payroll Friday, there's a good chance that the jobs number will have a significant effect on oil markets overall. After all, the Federal Reserve needs to make a decision fairly soon about whether or not to taper off of quantitative easing, and because of that the labor market report will be very important.

If the jobs number is better than expected, there's a good chance that the Federal Reserve will taper off of quantitative easing fairly soon, and because of that the value the US dollar would of course go higher. On the other hand, if the number is very weak, there's a good chance that the Federal Reserve will hesitate on tapering off of quantitative easing, and this of course will send the value of the US dollar. Remember, this market is certainly priced in those same US dollars, and if the value of those dollars change, then certainly that will affect how many of them it takes to buy these barrels of oil.

I'm waiting until the end of the day.

Because of the volume being light for the last couple of weeks, and the fact that the Federal Reserve will be making this decision sometime next week, I think that waiting until the complete reaction, in other words the daily close of the market is probably going to be how I make my decision. I still think that the market has a somewhat of an upward bias to it, and because of that I think that the highs of the 112 level will be challenged again.

As far as selling is concerned, I see absolutely no reason to do so because not only do you have the Federal Reserve and the possibility of tapering, but you also have lots of headlines coming out of the Middle East at the moment that are supportive for the oil markets in general. With that being said, I actually like buying pullbacks on short term charts if we get that possibility.