Last Monday’s analysis ended with this prediction:

"It looks like the better trades will be on the short side, I have given up on a true bull reversal for the time being. In any case it looks quite likely to consolidate for a while so there many not be any really good opportunities for a while.

I recommend that traders for the time being look for longs off bullish price action at 0.8930 and shorts off bearish price action at 0.9057. I doubt that the trend lines are going to be much use to us any more."

This was a good prediction and very tradable, just after publication the pair hit a high of 0.9069, which was only 12 pips beyond the recommended level to look for shorts, before falling to a low of 88.91, reaching the stated support at 0.8930. A long at 0.8930 with a 40 pips stop loss would have yielded a win of 60 pips at the time of writing.

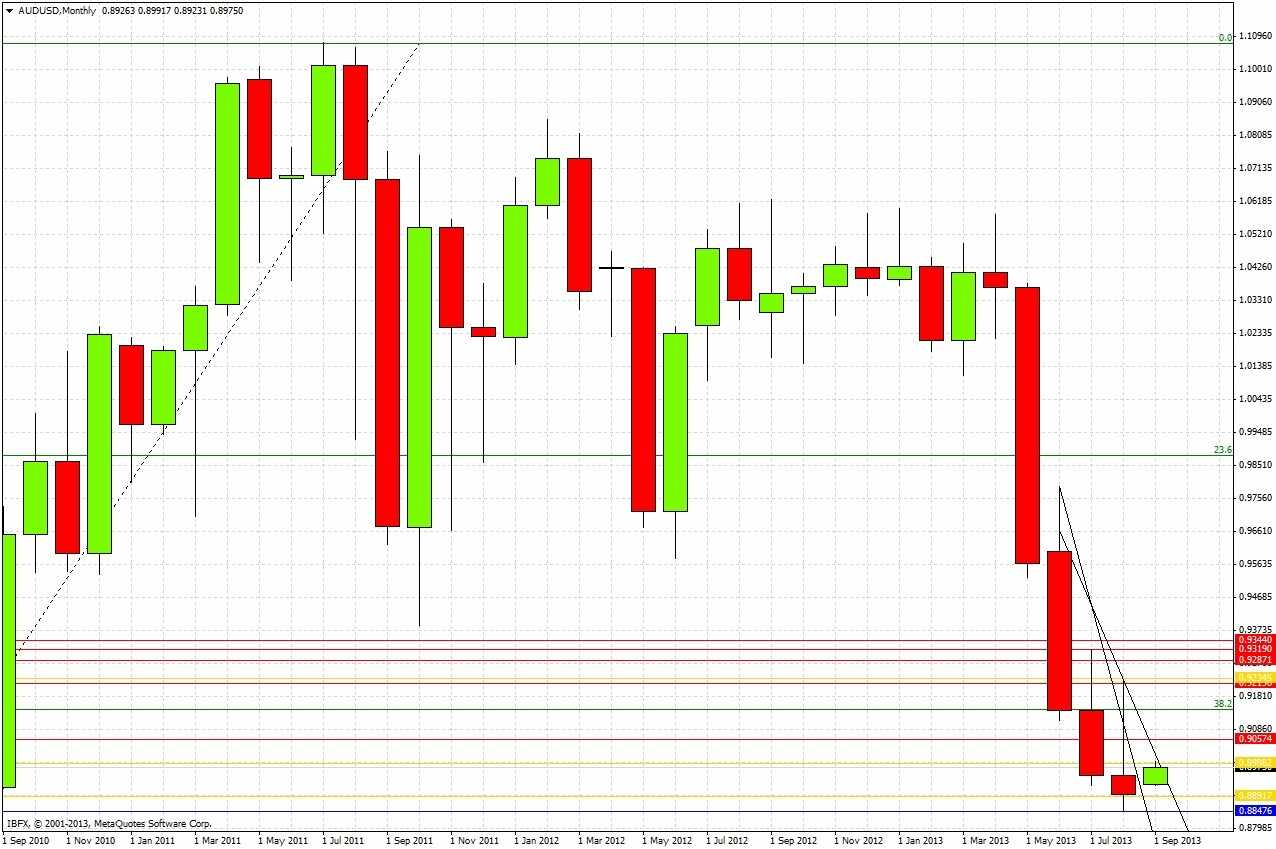

Looking to the future, it is a new month now so let's take a look at the monthly chart:

Last month produced a bearish bar, with a long upper wick. It is not a very strong candle leading to any forecasts, but from this it can be said that the long-term bearish trend is continuing for the time being.

The weekly chart adds some detail to the picture:

This weekly chart shows that we appear to be moving from trend into consolidation. The trend lines are looking less important and if broken again significantly should probably be discarded. The week before last was a bearish engulfing candle, but the low made a few weeks ago at 0.8850 has not been challenged and in fact support is holding so far at 0.8990. Having said that, the major moves over the last few weeks have been short, so it can be said that there is still a bearish trend, but it is slowing and running into support.

Let's drop down to the daily chart:

Summarizing important recent developments:

1. On Monday last week there was a bearish reversal candle off previous support that had become resistance at about 0.9050. Price fell.

2. On Thursday last week there was another bearish reversal candle, but:

3. The next day, the price found support at the previous low and turned around.

The price has risen very strongly today but is currently running into some resistance at the psychologically important round number at 0.9000. The AUD is very strong right across the board.

Right now it can only be said that shorts at around 0.9060 and/or longs at around 0.8890 look like the best opportunities. The level at 0.9060 is a little more comfortable as it is support turned into resistance, which tends to be reliable.

Another factor to consider about this pair over the coming days is that USDJPY looks like it may be breaking out of its summer triangle, in favor of the USD. If the focus switches to USDJPY and this breakout is confirmed tomorrow when the US returns from its holiday weekend marking the end of summer and the start of serious trading, this could mean a sharp move down, if this happens after we reach 0.9060 then that could be a short trade to hold onto for a while.